As trade policies make certain goods more valuable and holidays increase vulnerability, these items become prime targets for criminals.

Ilan Gluck, general manager of GearTrack, said tariff policies have triggered abrupt shifts in global supply chains, leading to rerouted shipments, last-minute logistics decisions and widespread stockpiling. The rapid changes are influencing new systems, routes and partnerships in real time, he said.

“This volatility has introduced vulnerabilities that are being actively exploited by bad actors,” Gluck added.

Danny Ramon, director of intelligence and response for Overhaul, said theft risk is closely tied to market volatility. Unlike companies, criminal networks can move quickly without bureaucratic delays, shifting focus within the time it takes to drive between two distribution centers.

“Any product that suddenly becomes in demand (for any reason) will be targeted as it will be able to easily and quickly be liquidated,” Ramon said.

While tariff-related pricing shifts haven’t persisted long enough yet to influence long-term theft trends, Ramon pointed to several examples of opportunistic targets. Seasonal demand spikes, like avocados before the Super Bowl, shingles and lumber after natural disasters, or solar panels in subsidy-rich states, illustrate how thieves adjust in near real-time.

The surge in paper product thefts (including paper towels and toilet paper) during 2020 is another example, Ramon said.

“The summation is that idle inventory does not make thieves money, so the more in demand it is, the easier it is to move, therefore the more attractive it is to the thief,” he said.

More inventory, more security measures needed

Gluck said a top concern voiced by customers is the growing threat posed to cross-border shipments.

“Stockpiles near border zones have become prime targets, with these areas emerging as hotspots for cargo theft,” he said.

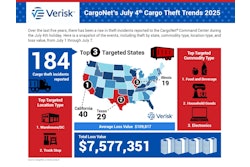

May data from GearTrack indicates California, Texas, and Illinois as top states at risk.

The report also noted that recent tariffs on imported vehicles and components may be contributing to increased vehicle-related thefts. States such as Pennsylvania, Tennessee and Illinois reported rises in cargo theft, with Kentucky noting a 200% increase.

“Although tariffs are affecting a broad range of asset categories, the most significant impacts are being felt in the food and beverage and electronics sectors,” Gluck said. “The greater the tariff pressure on a category, the more likely it is that cargo will be rerouted or stockpiled, conditions that significantly heighten its exposure to theft.”

Mike Grabovica, co-founder and CEO of Birdseye Security, which helps warehouses prevent theft, said while there’s a small spike, it’s unclear whether tariff policies have contributed to cargo theft yet.

“But are there more threats? Yes, for sure. Whenever you’re holding onto more inventory than you’d like to, you’re attracting a lot more attention and increasing more risk," Grabovica said. “If you’re increasing more risk, chances are likely that you will experience some hardships if you’re holding on to a lot more inventory than you’re capable of handling.”

Most logistics facilities have a set of protocols for handling an influx of volume. Adequate security is needed, Grabovica said.

“If you’re trying to stock up on inventory to beat tariff deadlines, and you’re looking to avoid certain hikes, and you’re carrying twice the amount of inventory, then chances are likely you’re not adequately prepared to hold on to that much,” he said, adding that companies may not have the right insurance coverage to protect against possible losses.

[RELATED: Cost per mile dips slightly thanks to fuel prices, truck and trailer payments soar]

A top mitigation factor during high-risk periods like the July 4 holiday or times of volatile tariff policy is visibility, Ramon said.

“If you do not know your cargo is exposed to risk, you cannot mitigate that risk,” he said. “While a successful security program contains many layers that work together, you cannot address a problem you cannot identify, and granular visibility provides the capability to identify specific risks and mitigate them in real time."

Ramon pointed out that the biggest blind spot in cargo theft prevention is double brokering. While common practice in logistics, double brokering, especially unauthorized or illicit double brokering introduces major risk, he said.

“In the event of a loss, it makes it difficult to gather information accurately," he said. "When practiced for the purposes of theft, it provides a cover that can be near impossible to defeat when investigating a loss and a carrier identity that can be ‘burned’ at the first sign of trouble catching up.”

Leveraging technology

While you can’t get a one-size-fits all solution to an industry-specific problem, Grabovica emphasized the significance of having an updated authorized list of protocols that are enforced.

Logistics facilities tend to be a little outdated when it comes to deploying technology, he said, encouraging carriers to consider replacing or amplifying their technology oversight.

Gluck said supply chain professionals should view the disruption as a time to double down on technology to improve supply chain planning and visibility, he said, adding that real-time, asset-level tracking tools can enhance visibility.