With rising fuel prices, falling freight demand and other factors, truck drivers are leaving considerably more driving hours on the table than a year ago, according to data collected by freight matching platform FleetOps.

Using ELD data, FleetOps found a 12% year-over-year increase in unused driving hours in June. A follow-up survey of owner-operators, drivers and carriers found that more than 50% reported spending less time behind the wheel with rising fuel costs and the costs to operate a truck in general being the biggest reasons why.

Joining Jason and Matt this week on CCJ's 10-44 is Chris Atkinson, co-founder and CEO of FleetOps, who talks about the data the company collected and what drivers and carriers had to say about it.

CCJ's 10-44 is a weekly video feature covering the latest in trucking news and trends, equipment and technology. Subscribe to our YouTube channel here.

Contents of this episode

00:00 The trend of unused driving hours

02:11 Why are drivers leaving hours on the table?

03:22 Inflation, fuel prices, and detention time

05:22 Planning for increased demand

06:33 Carriers and driver retention programs

Jason Cannon

This week's 10-44 is brought to you by Chevron Delo 600 ADF ultra-low ash diesel engine oil. It's time to kick some ash.

Matt Cole

What's behind the trend of truck drivers' unused driving hours?

Jason Cannon

Hey everybody, and welcome back to the 10-44 weekly webisode from the editors here at CCJ. I'm Jason Cannon, and my co-host on the other side is Matt Cole. Carriers' operating expenses have been climbing for the last couple of years. An ELD data collected by freight matching platform FleetOps shows just how much added cost is impacting truck drivers' time spent actually driving.

Matt Cole

To accompany the data the company was collecting, FleetOps also surveyed more than 900 carriers to better understand why drivers aren't maxing out their 11 hour clocks. Today, we're joined by Chris Atkinson, co-founder and CEO of FleetOps, who talks about what the company saw in its data and what carriers said about their unused driving time.

Chris Atkinson

Primarily, we match truck drivers with shipments using vehicle data. And we have obtained very critical access to some of the most valuable data points you can achieve access to in this industry. And that's propped up our network and propped up what we're doing today. We believe that vehicle data is the unlock for this industry's potential. There's a lot that you can do with it to optimize a driver's business, but also to optimize all the services that that driver interacts with as well. There's been a ton of discussion recently about how certain trends are negatively impacting drivers in 2022.

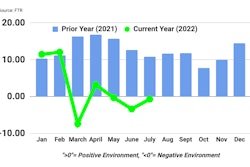

We're talking about inflation. We're talking about gas prices. Powered by ELD data, we wanted to take a hypothesis-driven approach and just confirm if we could see and observe the same impact on carriers. Based on that analysis, it was clear that there's been an increasing trend in the amount of unused hours drivers are leaving on the table before ending their cycles compared to last year. So for example, comparing June of last year to June of this year, we've seen a 12% increase in the amount of hours drivers are leaving available. So more drivers are driving less.

Jason Cannon

Chris says that with lower revenue per mile due to higher cost, it would make sense that drivers would be pushing to drive more to make up those losses. But a large majority of carriers surveyed said that's not the case at all.

Chris Atkinson

You want to ask these drivers, you want to find out from them, "Why are you leaving those hours on the table?" Right? You would expect that with lower revenue per mile, that drivers would be trying to drive more, that they'd be trying to make up for that time. And 71% have said that that rising cost of fuel, that declining demand from shippers that you're seeing in the market right now, I think it's overall for a lot of these drivers just decreasing the ROI and the worth of getting behind the seat of that truck when I can instead optimize my day, optimize my time around other earning potential that I have. I can go do other work. I can go do other jobs. I think that that's one of the primary things that you're identifying is that when the market decreases or when driver demand decreases, it's not necessarily true that drivers are going to try to make that up with more hours. It's instead true that they're going to begin working to do other things instead.

Matt Cole

By far the biggest reasons carriers reported unused hours were inflation and fuel prices. Behind that was reduced demand, and not surprising to many carriers, detention time.

Chris Atkinson

That's always massively contributing, and it's contributing for two reasons. One, if I'm waiting in detention and I'm not getting detention pay, which is, of course, always an issue, then I'm just burning time. I'm burning hours sitting there on duty. But it's also frustrating. It's really frustrating, right? I've driven a very long distance in order to deliver this freight. What I want is to be in and out as quickly as possible. And that's, of course, leading to what would be the emotional response of the stress associated with the job, with the work that you're doing.

Jason Cannon

If the trend of unused hours continues, Chris says it could be problematic for the trucking industry when demand picks back up. And he shares details on how after a word from 10-44 sponsor, Chevron Lubricants.

Protecting your diesel engine and its aftertreatment system has traditionally been a double-edged sword. The same engine oil that is so essential to protecting your engine's internal parts is also responsible for 90% of the ash that is clogging up your DPF and upping your fuel and maintenance costs. Outdated industry thinking still sees a trade-off between engine and emission system protection, and Chevron was tired of it.

So they spent a decade of R&D developing a no-compromise formulation. Chevron Lubricants developed a new ultra-low ash diesel engine oil that is specifically designed to combat DPF ash clogging. Delo 600 ADF with OMNIMAX technology cuts sulfate ash by a whopping 60%, which reduces the rate of DPF clogging and extends DPF service life by two and a half times. And just think what you can do with all the MPGs you're going to add from cutting your number of reagents. The Delo 600 ADF isn't just about aftertreatment. It provides complete protection, extending drain intervals by preventing oil breakdown. Before, you had to choose between protecting your engine or your aftertreatment system. And now, you don't. 600 ADF from Delo with OMNIMAX technology, it's time to kick some ash.

Chris Atkinson

Well, of course, as things tighten up, the trucking industry has this tendency to snap back and forth in either direction. So anytime you see utilization and demand decrease, both at the same time, you are not well-situated for a situation when demand picks back up. You are not well-situated for a situation where everything turns around. And that will mean that we could either see this worsen for a while as demand continues to decrease, and drivers continue to go and begin accessing other industries, and maybe some drivers or some fleets aren't able to make it out of this slower cycle. Eventually, it snaps back and you see prices rise really, really quickly because drivers, there just aren't enough drivers for that new pent-up demand that starts to flood into the market. So it would be, I don't think that you're going to see a more moderate future in either case. Depending on the macroeconomic environment, you're either going to see this situation worsen or prices rise really quickly at some point.

Matt Cole

While drivers might be leaving hours on the table now, Chris says carriers still need to be prepared for when the market flips back in their favor.

Chris Atkinson

There are always gains to be made. The United States is really a chessboard of moves that you can make as a carrier. And trying to select your freight and select your movements, thinking several different shipments ahead is how you can do that. This is something that we try to help drivers with. That's part of our job. But you can also strategize and just plan ahead as much as possible, try to get as much predictability as you can, so that you can run your business a little bit more easily. But the other thing I need to say here is that carriers, they need to focus on driver retention programs and potentially investing more in compensating and retaining those drivers to ensure that they're in a good position to take on more freight and take on more lanes when the market shifts.

Jason Cannon

That's it for this week's 10-44. You can read more on ccjdigital.com. And as always, you can find the 10-44 each week on CCJ's YouTube channel. If you've got questions, comments, criticisms, or feedback, please hit us up at [email protected] or give us a call at (404) 491-1380. Until next week, everybody stay safe.