The trucking industry is shedding jobs as it adjusts to post-pandemic economic conditions and political turmoil.

Latest data from Bureau of Labor and Statistics showed that the transportation sector lost about 1,900 jobs in February, continuing a trend of declining employment.

BLS also revised its previous data, showing that job growth was overestimated. Initially, it was reported that the industry added 4,100 jobs in December and January, but new data reveals that those months actually saw a loss of 800 jobs instead.

These corrections also change the broader trend. Earlier estimates suggested that trucking employment grew by 7,400 jobs between November and January. However, after including latest data, it turns out that the industry only gained 600 jobs between November and February—a much smaller increase than previously thought.

Along with downward benchmark revision made by BLS, the data now indicates that trucking employment has returned to pre-pandemic levels. In February 2025, the number of trucking jobs is just 0.1% below what it was in February 2020, signaling a stabilization in the industry after the hiring surge and declines caused by the pandemic.

[RELATED: Trucking jobs market suggests stability, as December data signals slow recovery]

The data reflects mixed signals of stability and weakness in the industry, said David Spencer, vice president of market intelligence at Arrive Logistics.

While there was optimism in the fourth quarter and early January, Spencer noted that seasonal slowdowns in February and clarity on the impact of tariffs have tempered positive expectations on positive trucking conditions.

Despite fluctuations, overall employment has stabilized since mid-2024, with job levels following the trend of freight rates bottoming out.

Further job declines are likely, Spencer pointed out, “The most likely scenario moving forward is a gradual downward trend in total employment as trucking companies continue to fight off lower levels of profitability and rightsize their operations to be as efficient as possible until we see a meaningful shift in market conditions.”

Mazen Danaf, senior economist at Uber Freight, agreed that the report indicated a mixed outlook on truck transportation jobs. While overall trucking jobs declined slightly, long-distance truckload employment took a bigger hit.

“This suggests a continued weakening in the long-haul segment of the trucking industry, due to the fading post-peak season optimism,” Danaf said. However, weekly work hours for long-haul truckers increased, he said, which might indicate tightening capacity due to prior job losses.

FTR Transportation Intelligence offered additional insight into specific trucking segments: General freight truckload employment lost 2,600 jobs in January, bringing it back to pre-pandemic levels. Local specialized trucking added 3,200 jobs, while local general freight lost 3,100 jobs, and less-than-truckload (LTL) and long-distance specialized trucking remain mostly unchanged.

FTR vice president of trucking Avery Vise pointed out that the BLS payroll data doesn’t fully capture the smallest trucking operations, which remain at historically high levels. “The truck freight market still has about 89,000 more for-hire carriers – most of which have just one truck – than it did in February,” he wrote. That represents a 35% increase despite a peak of more than two years ago. “This non-payroll capacity mostly would augment the payroll figures for general freight truckload and long-distance specialized.”

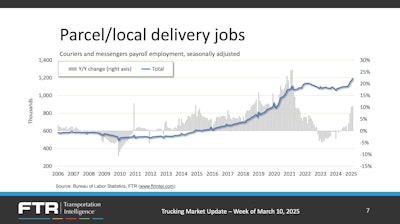

Last-mile delivery jobs surge

FTR also indicated a stark growth in parcel and local delivery employment, which saw strong job growth, adding 23,500 jobs in February and even larger gains in previous months.

The sector has experienced steady increases in the past four months, with a 32,900-job surge in November, one of the largest in record.

Vise pointed out that trucking jobs are driven by manufacturing and industrial output, whereas parcel and local delivery jobs are more tied to retail and e-commerce.

Danaf said that shifting consumer behaviors and e-commerce trends might be driving demand for last-mile delivery jobs, while long-haul trucking faces economic headwinds related to economic fluctuations, tariffs, and potentially shifting supply chains.

Even though manufacturing output grew slightly in February (up 0.7% year-over-year), Vise said it remains weak compared to retail trade sales (up 2.8% year-over-year) and online sales (up 5.9% year-over-year).

This highlights a divergence, as consumer spending (especially e-commerce) is boosting local delivery jobs, while trucking remains sluggish due to weak industrial production.

Manufacturing output and other industrial production, which are the most significant drivers of trucking activity, are indicators to watch closely to gauge the trucking labor market’s stability.

Vise said that industrial production is more volatile than consumer spending, making it harder to predict trucking employment trends, with tariffs and supply chain disruptions further complicating the outlook.

A sustained manufacturing rebound would also offer an earlier signal of recovery in trucking employment, he said.