Dry van and reefer rates on the spot market fell throughout 2022 after a record-setting 2021. By the end of 2022, rates were back to near pre-pandemic levels.

Last month, broker and 3PL Arrive Logistics released its annual Truckload Freight Rates Forecast for 2023, offering predictions for rates for the year ahead.

Jason and Matt are joined by David Spencer, director of business intelligence at Arrive, who goes into the details of the forecast and what carriers can expect this year.

Contents of this video

00:00 Dry van and reefer rates

01:44 Freight demand

02:55 Imports and manufacturing

05:34 Sliding demand, declining capacity, owner-operators

06:36 Spot rates

07:41 Will rates continue to fall?

08:52 Volatility in the spot market

Jason Cannon

This week's 10-44 is brought to you by Chevron Delo 600 ADF Ultra Low Ash Diesel Engine Oil. It's time to Kick Some Ash.

Matt Cole

After following throughout 2022, what should carriers expect from dry van and reefer rates in 2023?

Jason Cannon

Hey everybody, welcome back to the 10-44, a weekly webisode from the editors here at CCJ. I'm Jason Cannon and my co-host on the other side is Matt Cole. Dry van and reefer rates on the spot market fell throughout 2022 after a record setting 2021. By the end of last year, rates were back to near pre-pandemic levels.

Matt Cole

After a turbulent year for many carriers working the spot market, it's time to look ahead further into 2023 to get an idea of where rates might go as the year progresses. Late last year, third party logistics provider Arrive Logistics released its annual truckload freight rates forecast for 2023. We are joined by David Spencer, Arrive's Director of Business Intelligence, who talks about what the company expects as the year rolls along.

David Spencer

One of the things that we've noticed, and it's nothing new, but obviously there's a strong relationship between supply and demand dynamics in the industry and the relationship to rate movements as well. And we're really big effort put into understanding both current aspects of supply and demand and developing our forecast, and understanding of where we think both of those individual components were going to head as well. And various metrics that we track on a regular basis and that we look at; but essentially trying to understand those dynamics. And then on top of that, there's the art of trying to understand the psychology of how that means certain players within the industry are going to react as well, whether that's the carriers, shippers, or brokers like ourself.

Jason Cannon

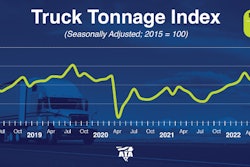

Looking at freight demand going into 2023, Arrive expects overall freight tonnage declines as economic conditions return to pre-pandemic levels.

David Spencer

From a demand environment, one of the components that we look at is obviously consumer health. I think that's an important factor, the whole consumer market; whether that's CPG or retail spending, makes up a portion of the freight that moves on the road. So we're obviously tracking what's going on with inflation, what's going on with spending, and what's going on in the labor market. And we think that's actually kind of a bright spot despite the level of inflation we've seen over the last 18 months with rapid price hikes. We're still seeing really relatively low unemployment rates. First of all, we've seen over the last couple years really in line with 2019 levels still today, and we're still seeing spending remain strong. We're seeing a little bit of a shift away from durable goods to leisure and services, so that's going to obviously take an impact away from some truckload demand. But ultimately we think the consumer sector has remained relatively healthy. And it'll be interesting to see what a continuation of Fed rate hikes will have on the ability of the consumer to maintain that health.

Matt Cole

David says some areas to watch that could impact demand are a decline in imports and a contracting manufacturing sector.

David Spencer

Other factors that we're looking at in this regard are imports, right? So we've seen a large portion of freight that moves on the road are imports, and we've seen a pretty significant pullback in imports. Some of that is seasonal and some of that is excess inventories built up at large retailers. So we got to be mindful that there could be a little bit of a bull whip or lag effect in terms of what we see in ports. But ultimately we've seen them regress to, I'd call them pre-pandemic levels at this point as of late. And I think that's a pretty fair estimate for where we'd expect them to continue to be.

And then the last portion would be the manufacturing sector is an industrial production, a big, big portion of freight that moves. You look at construction and housing, that's going to take a big pullback obviously with what we've seen in the housing market. But manufacturing was expected to be a sector that would bolster truckload demand. And over the last month here now in November, we actually saw the sector revert to contracting growth from 29 months of consecutive growth. So starting to see a weakening demand outlook from the manufacturing side there. So in summary, I guess what I would say is a pullback off of all-time highs, to more normalized or more moderate pre-pandemic levels.

Jason Cannon

Now on the supply side of the equation, David says sliding demand is going to result in declining capacity with authority revocations and drivers leaving the industry. We're going to hear more about that after a word from 10-44 sponsor, Chevron Lubricants.

Protecting your diesel engine and its after treatment system has traditionally been a double-edged sword. The same engine oil that is so essential to protecting your engine's internal parts, is also responsible for 90% of the ash that is clogging up your DPF and upping your fuel and maintenance costs. Outdated industry thinking still sees a trade-off between engine and emission system protection, and Chevron was tired of it. So they spent a decade of R&D developing a no compromise formulation. Chevron Lubricants developed a new ultra low ash diesel engine oil that is specifically designed to combat DPF ash clogging. Delo 600 ADF with Omnimax technology cuts sulfate ash by a whopping 60%, which reduces the rate of DPF clogging and extends DPF service life by two and a half times. And just think what you can do with all the MPGs you're going to add from cutting your number of regens. But Delo 600 ADF isn't just about after treatment. It provides complete protection, extending drain intervals by preventing oil breakdown. Before you had to choose between protecting your engine or your after treatment system, and now you don't. 600 ADF from Delo with Omnimax technology; it's time to kick some ash.

David Spencer

When it comes to capacity, obviously we've seen large growth in participants over the last couple years. And I think we're looking at not only the most employed marketplace we've ever seen, but now we're into an oversupplied market as we've seen demand easing. And so typically what happens in those scenarios, in any regular market cycle, is you would see participants begin to leave the market. And we think that's something that's going to happen this year. We begin to see drivers leave the market in search of better paying opportunities as we see rates collapse. And you'll continue to see revocations of carrier authority. And unfortunately it doesn't make sense for our operators to continue to go at it on their own. And this continued shift of owner operators away from going out on their own, to if they still want to be in the industry, there's a lot of benefits that they might see in a company job at this time. So some of that movement as well. But ultimately now that we're in an oversupplied market, we look for a correction to start to occur, which would eventually make the market vulnerable to another upswing.

Matt Cole

With those factors in mind, David says there's still a little room for rates to fall in Q1, but overall spot rates will say a more normal cyclical trend throughout the year.

David Spencer

A big part of what we expect to see with rates has already begun to occur this year. So we've seen pretty strong deflationary environments in the spot market. And so when talking about spot rates, we think a lot of decline has already occurred, in terms of actually reaching a bottom. As we get into a, I would call it a seasonal demand low in Q1, I think there's still a little bit of room left for rates to fall as we see demand kind of ease again further on a seasonal basis in Q1. And I think that's where it finds the bottom, later part of Q1 into maybe April. And then from that perspective, reach an equilibrium where we see more normal annual cyclical movements of rates where we might see a little bit of a pickup seasonally in the summer as it relates to summer peak season, say bottled beverage. And again in the fourth quarter when you see retail peak season pick up. More of a normal seasonal pattern and sort of an equilibrium pattern for spot rates after quickly finding a floor.

Jason Cannon

While Arrive forecast that there could still be some room for rates to fall, David says rates are already at or below break even rates for some carriers.

David Spencer

Even when we're looking at a national average right now, that's made up of some rates that are below carrier break even points and some that are above. And I think in many cases we're already seeing below break even rates as sort of a market average already from a carrier perspective, especially carriers that don't have the ability to operate with any economies or scale. And so that's something that is a concern.

And one of the reasons why the downward side to our forecast is much more limited, when I say downward side, we've included both a wide expanded band on our forecast around potential upward and downward movement, and the movement to the downside is much lower because we don't think that there's a lot of room left before we would see. Unfortunately, carriers are often put in a position where they're forced to decide to run unprofitably or park the truck, and it doesn't make sense to continue to run unprofitably. So that will pull capacity from the market and ultimately create upward pressure on spot rates. So it's a scenario where in an oversupplied market, those things occur.

Matt Cole

Of course, Arrive can't predict the future, so their forecast is based on current market conditions. If unforeseen events occur, like the early 2022 Russian invasion of Ukraine, they could cause more volatility in the spot market.

David Spencer

Where we're at in the current market cycle, it's such that you're still seeing such incredibly strong routing guy compliance for shippers right now. The market's so well supplied that it would take a major, major disruption, black swan event, in the first part of the year here, in my mind or in our mind, to cause any kind of extreme long-lasting volatility. In fact, as we've gotten into peak season this year, you see the spot markets have picked up a little bit. And the carriers and brokers who have contract freight, they've continued to accept it at the same rates because they're protecting business going into next year. So I don't expect to see a lot of any of those risks really stand out in the beginning part of the year.

But some of the things that we always watch for after an extended period of equilibrium to shake things up would be severe weather.We've seen hurricanes or severe winter weather really, really wreak havoc on balance of capacity nationwide and ability to service freight and what that does to rates. So weather's a big thing that we'd look for.

I know in our forecast we mentioned labor negotiations, which at least on the rail carrier side of things, things seem to be at a better place for now. And the risk of any kind of action there, it appears subdued. Now the attention would move to the longshoremen on the West Coast where there's certainly an opportunity for them to get their contracts in place, and we'll see what occurs there. That could shake things up. Additionally, we mentioned the carrier break even point. I think being mindful of the fact of understanding the cost to operate in the current environment and what impact that could have and certainly worsening economic conditions. Right now, there's some optimism given recent news on inflation and the feasibility to navigate a soft landing. But should we enter and see severe recessionary conditions, no telling what we could see from a demand perspective there.

Jason Cannon

That's it for this week's 10-44. You can read more on ccjdigital.com. As always, you can find the 10-44 each week on CCJ's YouTube channel. And if you've got questions, comments, criticisms or feedback, please hit us up at [email protected] or give us a call at 404-491-1380. Until next week, everybody stay safe.