Mileage has traditionally been used by truckload carriers as the basis for pricing loads, billing customers and paying drivers. In this low-margin industry, however, time has always been the more important denominator.

ELDs have been the impetus for motor carriers moving to time-based driver pay models.

ELDs have been the impetus for motor carriers moving to time-based driver pay models.Increasingly, motor carriers are converting to time-based measurements to create alignment between these critical business processes. As part of this effort many are using their data and information systems to create hourly and salary driver pay models.

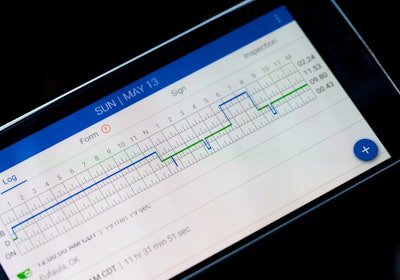

Electronic logging devices (ELDs) were the impetus of this change by creating operational visibility of where time and money is being wasted. Beyond ensuring drivers are complying with hours-of-service rules, the technology captures a minute-by-minute record of the 14-hour duty cycle to see where time is used on productive and non-productive activities.

Prior to ELDs, fleet managers knew — and often expected — drivers would make up time lost when loading, unloading or stuck in traffic jams. Drivers fabricating paper logbooks that were pencil whipped in the office made it possible for mileage-based freight rates to be artificially aligned with mileage-based driver pay.

In the ELD era, fleet executives can no longer afford to price loads and bill customers solely on the basis of rate-per-mile. Using revenue per day is the more important measure for business profitability.

“We have to meet a revenue projection per day [for a truck], regardless if a load is 168 or 500 miles,” says Ed Nagle, president and chief executive of Nagle Companies, a 50-truck refrigerated carrier based in Toledo, Ohio, that services the East Coast.

Most costs for a trucking operation are fixed, he explains, except for maintenance, fuel and accessorial charges. Increasingly, many fleets that are paying drivers by the mile have to count their largest expense as a fixed cost if they have minimum guarantees for drivers’ weekly paychecks.

Hiking salary pay

Nagle Companies moved drivers to a starting salary in 2017 at $1,100 per week. Drivers’ weekly play fluctuated before this. Some weeks they might be limited, due to no fault of their own, to between 1,600 and 1,800 miles and fall short of the fleet’s bonus threshold at 2,000 miles.

Drivers might earn $800 one week and the next week make $1,700 depending on when their paperwork was received.

Ed Nagle, president and CEO of Nagle Companies, announced a 17% percent salary increase for drivers.

Ed Nagle, president and CEO of Nagle Companies, announced a 17% percent salary increase for drivers.Nagle said his management team concluded “it was up to us” to make sure drivers make a certain amount per week, and the salary ensures drivers are compensated for productive time they lose for taking loads with multiple stops.

“Most people who are professionals get paid a salary,” Nagle explained, “and the reality is we are looking for drivers who look at this profession as something that is critical to our industry and to our society. We want those who are committed to it. We do not just want steering wheel holders. We want drivers who are critical thinkers and can trip plan and have all the positive attributes of a good driver.”

The carrier requires at least two years of previous over-the-road experience for new driver hires, but “we will not seriously look at drivers unless they have 5 years,” he said.

Nagle Companies recently announced a pay raise that starts at $1,400 and reaches a top pay rate of $1,800 per week. The 17% increase is the largest driver wage increase in the company’s 36-year history. Drivers also have an opportunity to earn bonuses for safety and fuel efficiency.

The only requirement for drivers is to be available for dispatch. Nagle said drivers can expect that dispatchers will get them home to take a 34-hour reset with the goal to spend two nights home per week.

“A lot of times it works, but there are times it doesn’t,” Nagle said. “If drivers can plan on being away from home one weekend a month, they will never be disappointed.”

Paying by the hour

Like other carriers that transport hazardous materials, Liquid Trucking was an early adopter of electronic logs due to added scrutiny of this sector by the Federal Motor Carrier Safety Administration. As an early adopter, the company used the data to create an hourly pay system in 2012 with driver safety its primary goal.

Liquid Trucking has been paying drivers by the hour since 2012, and will be announcing a significant pay increase.

Liquid Trucking has been paying drivers by the hour since 2012, and will be announcing a significant pay increase.“Our drivers can slow down for weather and adverse conditions without having to worry about their pay being negatively impacted,” said Jason Eisenman, director of human resources for the Plattsmouth, Neb.-based fleet with 180 trucks.

Liquid Trucking currently pays an hourly rate of $23.75 for all time, counted down to the minute, that drivers log on the drive line. It pays a lower hourly amount of $19 for the first hour drivers spend loading, unloading and at tank washouts, and $14 per hour for extended time.

This pay structure gives drivers an incentive to maximize drive time and minimize time spent in non-driving duty status.

Liquid Trucking’s in-cab mobile communications system has macros in the workflow that drivers use to mark arrival and departure events. These event records are used as basis for its hourly pay rates. The tracking of time begins at the moment drivers hit an arrive macro on the in-cab mobility system when they come to shipping, receiving or tank wash locations, and ends when drivers select a depart macro.

When drivers arrive, the first thing they do is set their air brake and send the macro to ensure their non-drive time is recorded for pay. Likewise, drivers send a depart macro at the moment they are loaded or unloaded and ready to move. This ensures that drivers get paid for all drive time at the higher rate.

“Drivers like being able to control their pay times,” Eisenman said. As a side benefit, Liquid Trucking has more accurate time and location-based data for arrivals and departures to use for calculating detention times and freight rates.

The company also pays drivers an hourly bonus of up to $3 for all drive time. Drivers qualify by hitting fleet targets for productivity (truck revenue) and performance measures during the preceding quarter.

The top 20% of drivers in the performance measures receive the max bonus. The bonus is scaled down for the remaining performance groups. Drivers in the second group are in the top 20% to 40%, and so forth. Only the fifth group at the bottom 20% do not qualify for the bonus.

The program ensures that 80% of all drivers receive an hourly bonus of some amount.

Next week, Liquid Trucking will be announcing a significant pay raise. CCJ will share the details of this raise along with other investments the company is making in technology to increase driver comfort, safety and convenience on the road.

According to CCJ’s 2020 What Drivers Want survey, drivers rank lack of home time and irregular pay as two of the top three reasons why carriers have a hard time finding and keeping them. Besides using time-based measures to more closely align revenue and cost formulas, time-based pay models seem to be a winning formula for driver satisfaction.