Calling for bipartisan support of transportation infrastructure investment, President Obama on Wednesday proposed a 4-year, $302 billion plan that would both shore-up the failing highway trust fund and increase federal spending.

President Obama gets an inside look at a light-rail commuter train in St. Paul, Minn., Wednesday, before announcing a new round of TIGER grants. (White House photo)

President Obama gets an inside look at a light-rail commuter train in St. Paul, Minn., Wednesday, before announcing a new round of TIGER grants. (White House photo)As the president addressed an enthusiastic crowd in the Midwest, a key House Republican unveiled his own tax reform package and infrastructure funding boost. Also in Washington, transportation interests gathered for a House roundtable, while an association of state government highway agencies met and talked reauthorization, as well.

So it was an active day, as policymakers grapple with diminishing fuel tax revenues and a federal transportation spending package that expires at the end of September.

At the heart of the president’s pitch is $150 billion in one-time “transition revenue” from “pro-growth” business tax reform.

“We’re going to close wasteful tax loopholes, lower tax rates for businesses that create jobs here at home, stop rewarding companies for sending jobs to other countries, and use the money we save to create good jobs with good wages rebuilding America,” Obama said, speaking at the recently renovated Union Depot train station in Saint Paul, Minn. “It makes sense.”

With the old train station – now a sparkling light rail transit hub – as the backdrop, the president also launched a new round of competitive TIGER grants, offering another $600 million in federal funds to cities and states to leverage funding from other sources for “transformative” infrastructure projects.

The TIGER program, initially part of the American Recovery and Reinvestment Act, has awarded $3.5 billion to 270 projects in all 50 states, according to the White House. During the previous five rounds, the Department of Transportation received more than 5,300 applications requesting nearly $115 billion for transportation projects across the country.

The new funding is a result of the bipartisan Consolidated Appropriations Act, which the president signed in January.

And while Obama credited those members of Congress who have been willing to “reach across the aisles” on infrastructure, he reemphasized his administration’s willingness to act independently when and where there are jobs to be created.

“Infrastructure shouldn’t be a partisan issue: Everybody uses roads, ports, airports,” he said. “Unfortunately, there have been some Republicans in Congress who refuse to act on common sense proposals that will create jobs and grow out economy.”

And transportation projects will be “in jeopardy” unless Congress passes a new transportation authorization.

“If Congress doesn’t finish a transportation bill by the end of the summer, we could see construction projects stop in their tracks, machines sitting idle, workers off the job,” he said.

The president also noted that other countries “are not waiting” to rebuild their infrastructure.

“They’re trying to out-build us today so they can out-compete us tomorrow,” Obama said. “The bottom line is there’s work to be done – and workers ready to do it. Rebuilding our infrastructure is vital to business and it creates good paying jobs that cannot be outsourced.

“This is one of Congress’s major responsibilities: helping states and cities fund new infrastructure projects.”

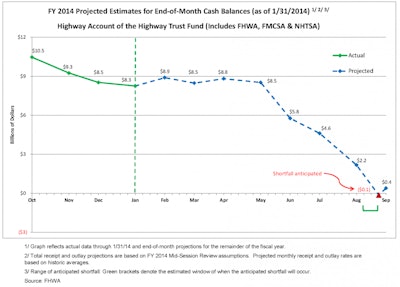

The latest Highway Trust Fund ‘ticker’ from the DOT (click to enlarge)

The latest Highway Trust Fund ‘ticker’ from the DOT (click to enlarge)But, despite the political rhetoric, the president’s not the only official with a plan. Also on Wednesday, House Ways and Means Committee Chairman Dave Camp announced a sweeping proposal aimed at simplifying the tax code by eliminating many deductions while lowering some tax rates. Designed to boost economic growth and job creation, Camp’s plan would also dedicate an additional $126.5 billion to fund highway and infrastructure investment.

Reaction to both proposals was cautiously optimistic at best, though skeptics concede any plan with enough substance to analyze moves the debate forward.

“It is heartening that both President Obama and Chairman Camp recognize the critical need for revenue to finance infrastructure improvements,” American Trucking Associations’ President and CEO Bill Graves said in a statement. “While a sustainable source of long-term, funding would be preferable, given the apparent reluctance to embrace traditional, user-funded revenue streams, ATA is prepared to keep an open mind when looking at financing options for the Highway Trust Fund.”

Transportation and Infrastructure Committee Chairman Bill Shuster also suggested tax reform “could play a meaningful role” as his committee works on reauthorization legislation.

“I am committed to moving forward with fiscally responsible transportation solutions to promote competitiveness and economic growth, reform programs, and focus our resources where they are needed most,” Shuster said. “Chairman Camp and President Obama have presented proposals that I hope will bring increased focus to the challenges facing the Highway Trust Fund and the importance of the federal role in our national transportation system.”

A key player from the other side of the Capitol and the other side of the aisle expressed doubts about both proposals. Sen. Barbara Boxer, chairman of the Senate Senate Environment and Public Works Committee, argued that Camp’s tax reforms are too comprehensive to get through Congress ahead of the MAP-21 deadline. And while the yet-to-be specified corporate tax reform promised by the president might be a more viable solution, it’ll be tough to sell to Republicans.

“I think it’s good, but I don’t hold out hope for it,” she said, speaking at an American Association of State Highway and Transportation Officials conference.

Boxer, who would like to see the fuel tax shifted upstream, also doubts Congress has the political will to increase the tax at the pump – but that’s what several participants continued to advocate at a House reauthorization discussion Wednesday.

Darrin Roth, ATA’s director of highway operations, represented trucking at the transportation committee roundtable. And while his presentation touched on trucking-specific topics such as hours-of-service, CSA, and truck productivity, the emphasis was on the need for a long-term bill.

Specifically, in a time of limited funds, ATA would like to see a higher priority placed on improving freight transportation.

As for covering the funding shortfall, ATA continues to push for a diesel tax increase – and to oppose tolling, specifically on existing Interstates.

Others transportation interests in on the discussion expressed support for “innovative financing” sources, such as public-private partnerships and a federal infrastructure bank.

“Everyone seemed open to alternatives, but no one really gave any specifics,” Roth told CCJ. “But, particularly in light of the announcements from the president and Chairman Camp, I think everybody was suggesting those aren’t ideal solutions – it would be much better to have a user-fee solution. But if that’s what it going to take avoid sending the Highway Trust Fund over a cliff, then that’s something they could be on board with.”