Anderson Trucking Services CFO Paul Pfeiffer says in his annual trucking report that truck prices will be up in 2024 but that manufacturers will do a better job of meeting replacement levels. As maintenance goes, a downside of increased new-truck prices is that fleets tend to run their equipment longer than they typically would.

In fact, registration data indicates the average age of Class 8 trucks is now 4.5 years, having crossed the 4-year-old mark in mid-2022. Previously, the average age was closer to 4 years or newer. “This has increased equipment wear and tear and accelerated the frequency of equipment maintenance,” Pfeiffer writes.

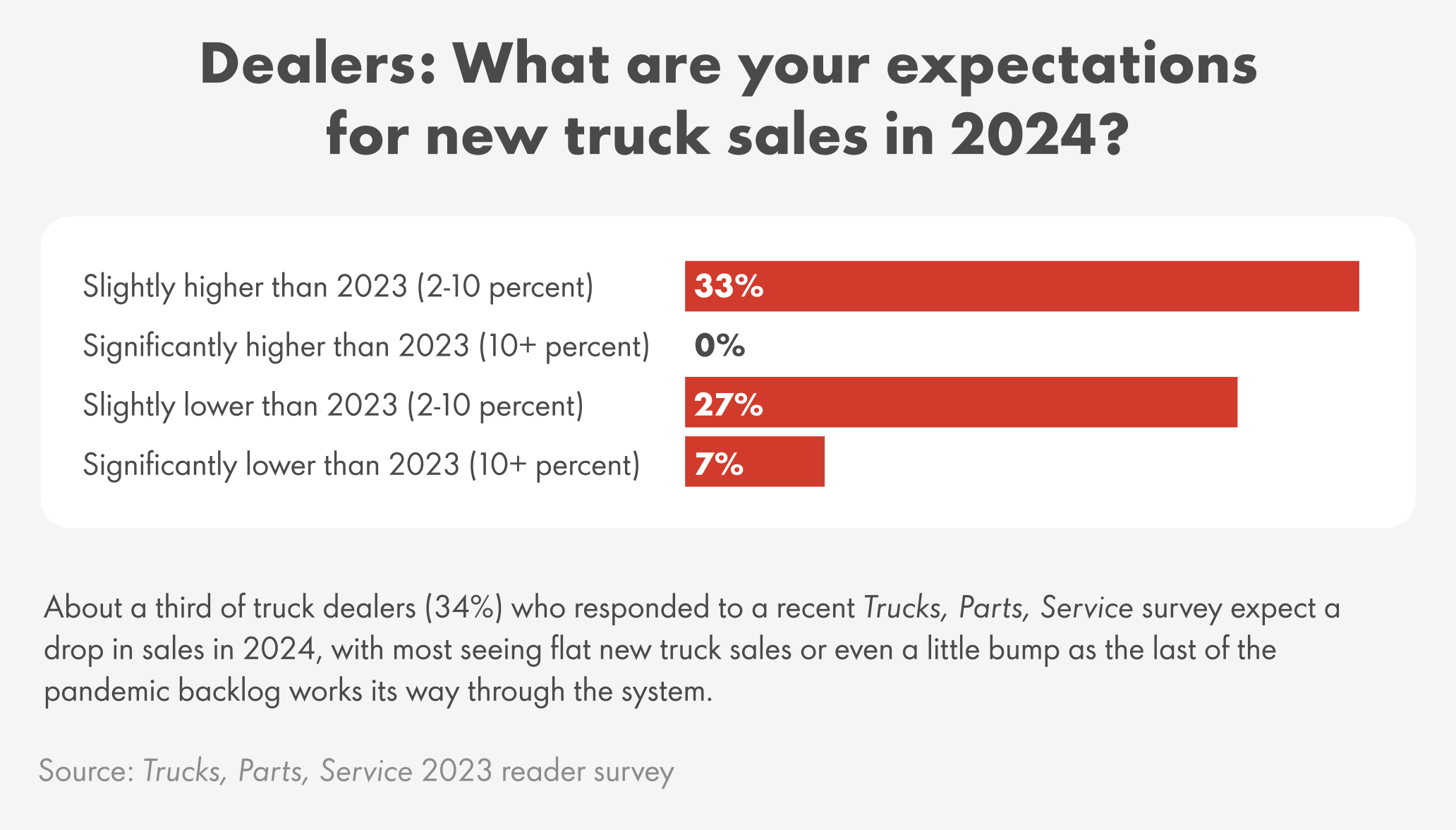

Despite 2023’s challenges, many dealers say new truck sales were still surprisingly strong. “I’m a little baffled by what happened this past year,” Rusty Rush, president, chairman and CEO of Rush Enterprises told Trucks, Parts, Service during Rush's Tech Skills Rodeo in December. “I’m surprised we had such a strong year in sales.”

Burg is holding off on placing new equipment orders until he knows what this year will look like and whether interest rates will continue to climb. He says his company’s sturdy balance sheet allows him to maintain his current fleet longer to weather any downturns and hold off on new purchases if needed.

“We have put ourselves in a good financial position; I am in really good shape right now as far as purchasing,” Burg says.

Lafayette Logistics in Indiana is not waiting to purchase new vehicles; the company began adding to its fleet as soon as 2024 arrived. But they are also watching the volatile market and making measured decisions accordingly. The company has a 40-unit fleet, which hauls general freight and auto parts. Their fleet is primarily made up of Kenworth and Peterbilt trucks, but they are making a gradual transition to Volvos.

Dustin Hardebeck, operations manager for the company, says they had their best year ever in 2023, so with the arrival of the new year, they were in a stronger position to purchase. “We had not been buying,” Hardebeck says of the past year or so, but buoyed by a strong year, they decided now was the time.

“We have already bought three new trucks this year,” he says.

Hardebeck says insurance and interest rates are also determining factors.

“We don’t normally purchase brand new $150,000 trucks with a 5-year loan at 9 percent,” Hardebeck says, adding that they look for deals.

“We wait until the market is right; we don’t buy because we feel like we have to,” he says.

Fleets that are opting to keep their trucks longer should take a close look at their maintenance practices, says Tom Mueller, general manager of Commercial Road Transport Lubricants. “Now is a great time to evaluate the suppliers you partner with to keep your trucks on the road,” he says. “Shell not only has top-tier products and ample supply, but we also have experts who can help you with choosing the best fluids and service intervals to suit your particular fleet and its duty cycle.”

Mack Trucks’ President Jonathan Randall thinks fleets will still step up to buy. Speaking at Heavy Duty Aftermarket Dialogue, as reported in Trucks, Parts, Service, Randall estimated the 2024 Class 8 market in the U.S. and Canada will be only slightly smaller than 2023 at 290,000 units – with Mack’s data indicating the 2023 market was 330,849 units.

Randall said pre-pandemic, dealers placed between 30 and 40 percent of heavy- and medium-duty truck orders without a customer allocated to them, just to have them on site.

That’s not the case anymore, Randall said. Ninety-four percent of Class 8 orders Mack received in 2023 were allocated to a fleet when ordered.

“[In 2023], the customers wanted more than we were able to deliver,” he said. When it comes to future truck purchases, “customers have learned they need to plan further out,” he said.