As 2014 begins to unfold, trends start to establish themselves and holdover campaigns that built momentum in 2013 begin to take root.

Graphic courtesy ‘Trends in the Transportation Industry” report.

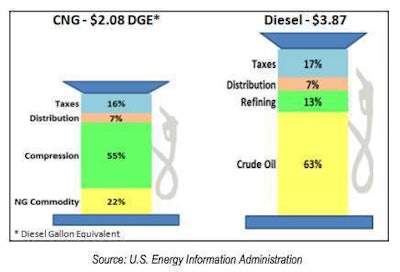

Graphic courtesy ‘Trends in the Transportation Industry” report.Natural gas’s place in trucking was arguably one of the hottest non-Hours of Service related topic from 2013, and it has not cooled down nearly four months into 2014.

“Trends in the Transportation Industry,” a report recently released by the Tompkins Supply Chain Consortium, says the case for carriers converting portions of their fleet to run natural gas seems to be taking hold.

“In 2013, Cummins made available a 12L natural gas engine capable of up to 400hp and 1450 lb-ft of torque. While this is not as powerful as similar-sized diesel engines, it is more than enough power for over-the-road hauls in all but the most mountainous parts of the U.S.,” says Chris Ferrell, director of the Tompkins Supply Chain Consortium, and who authored the report. “Although the upfront costs are higher (i.e., natural gas engines are at least $35,000 more expensive than their diesel alternative), the case for conversion is quite compelling: the cost per gallon equivalent of natural gas is typically between $1.50 and $2.00 less than a gallon of diesel. As of January 2014, the difference was $1.79.”

Aside from monetary savings, Ferrell says the environmental benefits of natural gas shouldn’t be overlooked.

“Natural gas creates about 30 percent less carbon emissions than diesel,” he penned in his report. “In addition, natural gas is both abundant in supply and locally sourced. Around 98 percent of the natural gas consumed in North America is domestically produced, and the continent is estimated to have a known reserve that could last for 120 years.”

A copy of the report, which covers topics including right-shoring, dedicated fleet expansion, intermodal growth, big data, capacity and industry consolidation, can be found here.