Drivers in the coming years will remain hard to come by, but truckload rates could climb as much as 9 percent for some carriers in the next 18 or so months, said Donald Broughton, trucking industry economist and managing director of Avondale Partners.

Donald Broughton

Donald BroughtonBroughton offered a 2015-2016 trucking industry outlook this week at CCJ’s Spring Symposium, held in Birmingham, Ala., for fleet managers and executives.

Broughton told attendees the U.S. economy as a whole is at an important crossroads currently, as much of the recovery since the 2008-2009 recession has come from the industrial side of the economy, rather than from consumer activity.

Indicators presently point to the industrial economy slowing, if not stopping, Broughton said, and consumer activity must pick up the momentum to sustain the economic recovery.

Much of the trucking industry’s success in the coming years hinges on that too, Broughton said, as inventories in manufacturing and retail continue to outpace actual sales. An uptick in consumer activity would move the economy closer to a more balanced inventory and sales ratio.

But moving through 2015 and into 2016, the industry is in a much better place than it was in 2012 and 2013, Broughton said, and some positive trends started in 2014 should continue, such as better truckload pricing power for carriers, better contract rates and continued increases in tonnage.

Broughton predicts rates to climb between 4 and 9 percent between now and the end of 2016, he said. “I usually do a tighter range than than,” he said. “This is a big range, because there will be vast disparity in the pricing power carriers are able to achieve. And a lot of that is based on contract timing.”

Many shippers, who didn’t think the 2014’s slight capacity crunch and subsequent rates upswing were real, are now trying to lockdown contracts with carriers as quick as they can before rates climb higher, Broughton said.

Cheaper diesel, which obviously has lowered carriers’ costs in recent months, has also diverted would-be rail freight to truck freight, helping increase truckload demand, Broughton said.

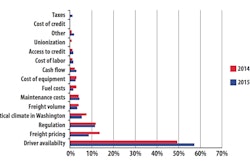

Broughton also said he’s keeping an eye on the impact upcoming regulatory changes, like an electronic logging device mandate, will have on the industry’s capacity. CSA likewise “creates all kinds of issues,” he said.

The industry should continue consolidating via acquisitions and mergers, he said, and consolidation could be “poised to dramatically increase.”