Chris Pickett, of Pickett Research, foresees the current boom cycle fading early this year after the months-long acceleration in the second half of 2020: “If this cycle behaves in a way that is in any way similar to truckload cycles over the past 15 years, which I have no reason to think otherwise, I expect to see our peak by the first quarter of this year at the latest, if not the fourth quarter that we just wrapped up. And once we observe that turn in the year-over-year cycle, we can start planning for the subsequent collapse leading into the final deflationary leg of the cycle – before we start all over again.”

Chris Pickett, of Pickett Research, foresees the current boom cycle fading early this year after the months-long acceleration in the second half of 2020: “If this cycle behaves in a way that is in any way similar to truckload cycles over the past 15 years, which I have no reason to think otherwise, I expect to see our peak by the first quarter of this year at the latest, if not the fourth quarter that we just wrapped up. And once we observe that turn in the year-over-year cycle, we can start planning for the subsequent collapse leading into the final deflationary leg of the cycle – before we start all over again.”Where are freight demand and, more importantly, truck freight rates headed in 2021?

Analysts weighing in since the new year began mostly offer a rosy outlook as the freight recovery that burgeoned in the back half of 2020 is expected to continue through at least the first half of 2021, and potentially through the entire year. However, one prominent analyst contends that the freight market this year is headed toward a slowdown as part of a natural cycle.

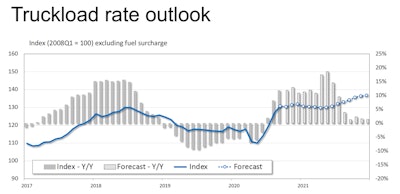

Forecasting firm FTR is bullish on 2021’s freight market, estimating truck loadings to rise 5% in 2021 from 2020, which saw a 4% dip from 2019. “It’s hard to conceive of a scenario in which 2021 is not a good year” for freight and rates, said Avery Vise, FTR’s vice president of trucking. FTR predicts rates to climb 10% on aggregate, which includes growth in both contract and spot rates.

“Freight patterns in 2020 were unlike any other year,” said Paris Cole, CEO of Truckstop.com. He expects freight demand in 2021 to return to a more predictable and seasonal pattern – slowness in January and early February, growth into spring and early summer, and then the usual slowdown through year’s end.

“In terms of load volumes, what we’re looking at is – is this sustainable? Are we going to continue to have really strong freight volumes in the spot market? If so, for how long?” Cole said.

Should COVID-19 vaccines become widespread enough by mid-year that consumers start venturing out of their homes, the pandemic-driven surge in consumer-driven e-commerce could slow. “We could see a flip from goods over to services, and that would cause freight volumes to decline,” Cole said, noting that people would be more likely to go to ballgames and restaurants instead of staying home and ordering goods online.

Vise agrees that shifting consumer habits could alter the pandemic-driven freight patterns in the back half of the year, but freight shifts could boost other sectors that have been lagging in the recovery.

For example, said Vise, the ISM manufacturing index posted its best month in more than two years in December, signaling recovery for industrial activity – a prime sector for freight – is starting to gain steam.

FTR forecasts rates to climb 10% in 2020 compared to 2021, aggregating spot and contract rates.

FTR forecasts rates to climb 10% in 2020 compared to 2021, aggregating spot and contract rates.

Likewise, ongoing capacity constraints, especially in terms of driver recruiting and retention, stand to only benefit per-mile rates. “Even if freight demand does not continue at the pace that we’ve been seeing, the capacity side will lag through most of the year,” Vise said. “From the carrier perspective, we think it’s going to be a strong year.”

Chris Pickett, market analyst at Pickett Research, has tracked freight and rate cycles over recent decades’ economic ups and downs, and he’s more pessimistic than Cole and FTR’s forecasters.

The market exists in boom and bust cycles, and he contends the market was ripe for the boom part of the cycle in late 2020 and early 2021. “And that’s exactly what we got,” he said, after the market crash and quick recovery in last year’s second quarter. In the back half of 2020, “rates march sequentially higher, which is exactly what was arguably supposed to happen as part of the normal cycle,” he added.

That cycle could play out in the first part of 2021, before rates begin another recessionary cycle, he said.

“If you’re a carrier, expect the spot market to weaken over the next few months,” he said. “To the extent you can, you’ll want to be overweight contract and underweight spot from a fleet allocation standpoint.”

Pickett said he’s watching Class 8 truck orders, indices around freight demand, industrial production and consumer consumption habits as to whether the market’s hit its inflection point.

“When consumption abruptly shifted from services to goods during the depths of the downturn, the trucking industry got an unexpected tailwind. Presumably when consumption shifts the other way, we will see the opposite,” he said. “We could very well see an environment characterized by strong GDP numbers yet disappointing domestic truckload freight demand – at least relative to 2020.”

This two-part series takes a look at what might be in store for trucking and motor carriers in 2021. The first installment explored trucking regs to watch for in 2021. Read it here.