In a slightly abbreviated version of CCJ Indicators, here are two key reports from the most recent week:

[gttable cols=””]

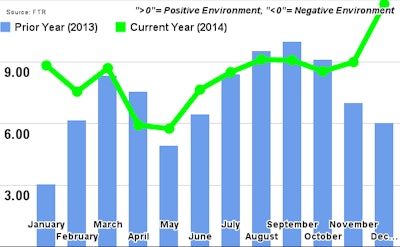

Trucking Conditions soar, outlook uncertain: Playing off of the strength of spot market rates seen in the last half of 2014, contract rates continue to rise, FTR reported last week in its monthly Trucking Conditions Index report. However, outlook for diesel and capacity could cause the TCI to fall a bit in the coming months, FTR says. Despite the Index’s 30 percent increase in December from November, the outlook for 2015 — potential resurgence of higher diesel prices, relaxation of capacity constraints, etc. — is a little murky, FTR says.

The index will probably fall to the 8-9 range this year, FTR reports, which still indicates a positive environment for carriers.

“Fleets were hitting their stride to finish the year, led by a dramatic drop in diesel prices and continued strength in contract pricing,” says FTR’s Jonathan Starks. “However, there are several indicators that lead us to exercise caution as 2015 plays out.”[/gttable]

[gttable cols=””]

Truck demand stays strong: Class 8 orders in January remained elevated, according to ACT Research, who pegs January’s order number at 35,226. “To put some context on Class 8 order strength,” says ACT’s Kenny Vieth, “January marked the fourth consecutive month in which orders were booked above a 400,000 unit seasonally adjusted annual rate, the eight consecutive month with orders booked in excess of a 345,000 unit SAAR and the 12th time in the past 13 months that orders have exceeded a 300,000 unit SAAR.”[/gttable]