Representatives from three very different fleets sat down with moderator Molly MacKay Zacker at the Heavy Duty Aftermarket Dialogue (HDAD) on Monday.

Terry Wall is the senior manager for maintenance and technical support, national accounts, for Ryder. His company runs between 100,000 and 150,000 power units nationwide and oversees 800 service locations. He says Ryder "definitely" bought more than 500 trucks last year and has dabbled in alternative fuels.

Justin Olsen is the Eastern regional maintenance manager for TCW. His company operates 325 trucks on mostly intermodal business with slip seat drivers. TCW bought around 125 trucks last year, and Olsen says more purchases were pushed to 2024., when the company plans to buy around 50 trucks. The company doesn't do much with alternative fuels yet, Olsen says, but expects that will change when port requirements change.

Doug Arns is the director of maintenance for Freymiller. He says the company has around 730 trucks and 1,100-1,200 trailers at any given time. The fleet is 100% reefer and they mostly handle no-touch freight. The company purchased around 150 new trucks last year and replaced reefer units on 150 trailers. Arns says he expects to purchase another 150 trucks in 2024. Freymiller previously tried natural gas trucks, but Arn says he wouldn't recommend it for his duty cycle and application.

For repairs, all three fleet representatives say they lean heavily on their equipment warranties. But if it's not under warranty, all three say they'll turn to the aftermarket where it makes sense. They're also continuing some practices they started during the pandemic parts shortages, such as remanufacturing some parts.

"The only thing we're still having issues with is the harder items, like harnesses," Olsen says.

Arns says he's also seen availability improve, except for things such as harnesses.

"Some are still on allocation," he says, where the dealer gets a limited number of parts and has to decide where to send them.

Wall says the sheer size of Ryder's fleet helps them with things such as parts availability and pricing, but the company is still seeing some difficulty on both fronts. He says Ryder's procurement team has conversations weekly about parts pricing, with a particular concern for the truck's next life.

"We look at our secondary market as a very important part of our industry," Wall says. "We want to make sure the truck is reliable."

Arns' computer system tracks pricing and he says he's seen some parts jump by 50-70%, and it's not necessarily all supply and demand. Olsen says tires are always going up and the company always keeps an eye out for ways to save.

Finding good help is a perennial problem in the industry. Arns is the only one who says technicians aren't necessarily a issue for Freymiller.

[RELATED: Ryder accelerating tech recruitment, training efforts]

"We've been pretty fortunate in that we don't have real high turnover with technicians," he says, adding the company pays for ASE testing and certification in full, and techs can get a pay increase and bonuses based on their accomplishments. When they do need new hands, Arns says the company has a relationship with the local trade school.

Arns' bigger concern is the availability of technicians when trucks are on the road.

"There's a lot of times one of our units will go down in the field, they'll roll into the dealer and I'll get a message that says, 'Hey, they don't have anyone to work on this for two days,' or 'They don't have anyone to work on a Cummins engine," Arns says.

For a reefer trailer hauling food, that can be catastrophic.

"If it doesn't get there in time, I have to buy that," Arns says. "Some of those meat loads are $500,000."

He says his company has gone so far as to go out and get the truck and bring it back to its Oklahoma headquarters for work.

All three representatives reported they've seen a gradual shift away from manual transmissions in the market.

Olsen says in the beginning, his company was 100% manual, but has had to move to automatic or automated manual transmissions to find drivers.

"That's mostly because people that are coming out of the truck driving schools aren't being taught how to drive manual transmissions," Arns says.

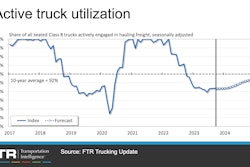

As far as what they'd like to see in 2024, Wall and Arns both picked the economy while Olsen says he needs parts more quickly. Wall says he'd like to see economic conditions as a whole on the upswing, while Arns homed in on freight rates in particular.

"Freight rates gotta go up," he says. "We're hauling the same volume as we did two years ago at half the price."