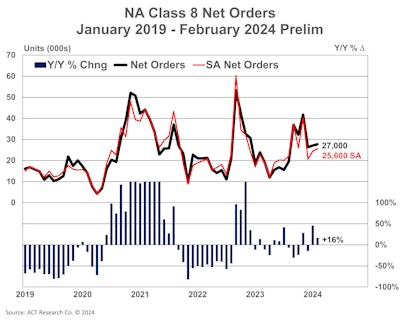

Despite the soft freight market, new truck orders saw gains in February, notably beating last year’s numbers.

ACT Research reported that Class 8 preliminary net orders for February came in at 27,700 units, up 600 units from January and 16% from a year ago.

NA Class 8 Net OrdersACT Research

NA Class 8 Net OrdersACT Research

Weak freight, carrier profitability fundamentals and large carriers lowering capital expenditures this year would imply pressure in U.S. tractor segment – North America's largest Class 8 market – said Kenny Vieth, ACT president and senior analyst.

“While we do not yet have the underlying detail for February order volumes, Class 8 demand continuing at high levels again [in February] suggests that U.S. buyers continue as strong market participants," he said.

Looking at North American vehicle demand this year, Vieth noted there are varying factors that could have led to order activity, starting with “pandemic ripples.” With ongoing healthy economic activity, he said pent-up demand continues to support elevated levels of medium-duty and heavy-duty vocational truck demand. That pent-up demand is also causing a shift in global supply chains, and a strong peso has also pushed vehicle demand in Mexico.

[Related: Mexico-bound Class 8 production to rise in 2024, says ACT]

The U.S. tractor market is the one spot in the Class 8 market that continues to surprise, Vieth pointed out, as it shows some resilience despite bottom-of-the-cycle for-hire carrier profitability. He added continued strength in private fleet order activity has offset weakness in for-hire carrier tractor demand.

“We believe that for-hire service disruptions during the pandemic and some forward-looking fleet positioning ahead of EPA 2027 low-NOx regulations are drivers of continued strength in private fleet orders," Vieth said.

This also lines up with observations and expectations from the commercial vehicle industry, said Jody Pollard, senior vice president of truck and aftermarket sales at Rush Enterprises, attributing the continued pent-up demand to the “allocation environment we’ve been operating under for the last few years.”

“Although rising interest rates and the freight recession have had a significant impact on Class 8 OTR carriers, at least from our perspective and from an orders standpoint, the vocational markets have been very strong," Pollard said. "As demand by OTR has softened, the construction, refuse and other vocational markets have been able to fill their backlogged need for Class 8 trucks. Our concern at this point is the second half of 2024 as needs are met in the vocational markets. We will be watching this carefully."

FTR's report said preliminary orders for Class 8 vehicles were at 25,700 units, which took a 9% dip from January, but is up 11% year-over-year. This number was “above seasonal expectations,” the firm said. Total orders for the past 12 months are at 263,700 units, with an average of 21,975 per month.

FTR Chairman Eric Starks said build slots continued to be filled at a reasonable rate. February orders are comparable to December 2023, indicating the market is still performing “at a solid level.”

“It was a mixed market for OEMs this month with some seeing increases and others seeing decreases in orders,” Starks said.

FTR indicated that concerns over a rapid easing of demand this year are not coming to fruition, nor is the market doing significantly better than replacement level orders. He noted that after peaking last November at 36,000 units, orders have stabilized at a level roughly 10,000 units lower over the last three months.

Despite a weak freight market that has lasted for more than a year, fleets are still willing to order new equipment, Starks said. Though order levels were “above the historical average and above seasonal trends,” he said FTR's expectations for replacement output by the end of the year remain unchanged.