Trailer orders saw nominal improvement from November to December, according to ACT Research. At 24,300 units, preliminary data indicated it was lower compared to last December, a decrease of nearly 58% year-over-year.

As it was during the peak order season, factoring in a seasonal adjustment, December’s data drops to 17,200 units. However, it’s still 10% higher than November.

December’s preliminary net orders aligned with expectations, said Jennifer McNealy, director commercial vehicle market research and publications at ACT Research. This comes as fleets have noted weak profitability and trailer manufacturers that have shared “orders are coming, but at a slower pace than they have the last few years.”

"This month’s results continue to support our thesis that when fleets don’t make money, their ability and/or willingness to purchase equipment is muted," McNealy said. "That said, the lower orders don’t indicate a catastrophic year in the offing either, simply the slowest December we’ve seen since before the pandemic began.”

She noted that other indicators that ACT Research is looking into include cancellations, which fluctuated above comfortable levels in Decembers, and the backlog-to-build ratio, which in aggregate is weakening, now around five months.

“However, some specialty segments have no available build slots until late in 2024 at the earliest, while others are in the three-month range,” she added.

Backlog-to-build ratio rise

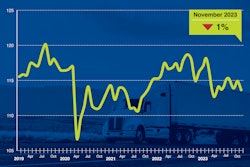

At the same time, FTR reported that trailer production slowed by 15% month over month in December. It was similarly down 15% year-over-year.

Though the build number was the lowest since the beginning of 2021, a drop in production after November is normal, noted FTR. Average monthly build is still healthy at more than 26,600 units.

“With orders coming in above production levels, backlogs in December rose somewhat, increasing by more than 3,000 units to more than 143,300 units in total,” said Eric Starks, FTR’s chairman of the board.

The fall in production and increase in backlogs resulted in an increase for the backlog-to-build ratio to 7.1 months, he said.

Due to lower production levels in December, which is above the historical average before 2020, the ratio is slightly high.

“A jump in the ratio is normal around the holidays, and the overall picture is still of an industry that is continuing its move towards a pre-pandemic level of stability," said Starks.

Similarly, McNealy noted that total cancellations increased to 1.7% of the backlog from November’s 0.9%, elevated for most segments and much higher for some. "Digging down, several markets were again above 1.0%, including dry vans at 1.3%, flats at 3.5%, medium lowbeds at 1.5%, and dumps at 1.3%. Both tank categories reported a spike in cancellations, both around 7% of the backlog," she added.

Recent oil price weakness is a possible factor, she said.