Don’t miss CCJ’s 2015 Fall Symposium. Click here to secure your spot.

CCJ’s Fall Symposium allows trucking industry professionals to network with their peers and industry suppliers and gain insights on the latest in regulatory changes, equipment and technology trends and the economic information you can use. |

CCJ’s Fall Symposium held earlier this month in Scottsdale, Ariz., served up topics of particular importance to more than 200 attendees as we close the book on 2014 and look ahead to the near future. And as a side note, my apologies to the left-of-center politically minded audience members as Fox News’ unabashed host Greg Gutfeld gave his opening remarks following the midterm elections. That must’ve been an uncomfortable hour.

Here are my five takeaways from this year’s event:

Regulations. Annette Sandberg, principal of TransSafe Consulting and former administrator of the Federal Motor Carrier Safety Administration, spoke about a number of pending and proposed rulemakings, including the long-awaited safety fitness determination rule scheduled for release in March. She said the rule is a major revision of the way FMCSA will rate trucking companies, calling it “problematic.”

Sandberg also said an erosion of medical standards by FMCSA, which is granting waivers to drivers with hearing and sight problems and perhaps even neurological disorders, could mean problems down the road for fleets who ultimately will be left to determine if a driver is fit for duty and opening themselves up to lawsuits under the Americans with Disabilities Act.

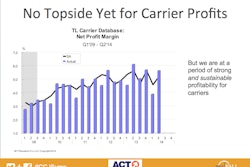

The economy. Jim Meil, principal of industry analysis for ACT Research, said that the trucking industry’s slow recovery from the recession will prove to be sustainable over the next several years. He predicts we’ll end 2014 with a 3.4 percent growth in GDP and 5.3 percent growth in freight for 2015.

Meil also remarked that the driver shortage is as much a harbinger of good business conditions as many other economic indicators, saying that it comes with the territory.

“The shortage in many senses is a problem of the fact that the economy is generating enough freight that hiring drivers to move the freight is a challenge,” said Meil. “Which would you rather have – not enough freight or not enough drivers?”

Technician shortage. While the driver shortage is top-of-mind for most fleet executives, the technician shortage could be just as critical to trucking operations but doesn’t even come close to getting the discussion it deserves outside of maintenance facilities and associations like the Technology & Maintenance Council.

“We have to start reaching out to kids at a much earlier age,” said Ken Calhoun, vice president of customer relations for Truck Centers of Arkansas.“We need to be talking to kids and their parents when they are in junior high school and tell them there is real earning potential for technicians in this industry. We need to think long term instead of always being in panic mode because we need technicians and it’s all about short-term instant gratification.”

Roadside violations. Steve Keppler, executive director of the Commercial Vehicle Safety Alliance, warned attendees that emerging technologies such as U.S. DOT sticker and license plate scanners and roadside-mounted infrared cameras that can detect brake systems that are running too hot or too cold will better enable law enforcement to identify trucks for further inspection.

Keppler advised fleet managers to maintain strong safety cultures. “The key is to develop and maintain the processes, habits and sustained behaviors that promote safety,” he said. “The sooner you do, the better off you’ll be in the long run.”

Driver productivity. Robust driver coaching programs certainly can make drivers safer and more efficient and productive employees, but the biggest constraint facing fleet managers in terms of maximizing asset profitability lies with excess detention time of trucks and drivers at shipper and consignee facilities.

Kevin Quast, chief operations officer for Knight Transportation, said it’s imperative to explain how shippers are involved in the process. “We have to get more money to drivers, and we can certainly do that through raising pay,” he said. “But if customers want to mitigate rate increases, they have to address the [detention] issue.”