After enduring a global economic downturn and diminished sales over the past couple years, the nation’s commercial truck dealers eagerly are waiting to get “back to normal” and setting their sights on the legislative and regulatory challenges ahead, said Kyle Treadway, chairman of the American Truck Dealers.

“It’s appropriate that we’re meeting in Phoenix – the city named after a mythical bird that rises from the ashes to begin life anew,” said Treadway in remarks Saturday, April 16, at the 48th annual ATD Convention and Expo, which runs through Monday, April 18, at the Phoenix Convention Center.

“Our industry has taken many punches,” said Treadway, a third-generation dealer and president of Kenworth Sales Co. in Salt Lake City. “In addition to the economic downturn, we’ve had to weather a series of regulatory changes that magnified the ups and downs of our already cyclical business.”

Treadway highlighted five sectors of commercial truck retailing that indicate an economic recovery is under way for 2011:

• Freight volumes are rising. “Freight rates are pushing upward with more industry-leading fleets announcing rate increases, giving our customers breathing room and the ability to generate profits,” Treadway said. “Experts now tell us that the manufacturing sector has emerged as our recovery’s leader. That’s good news for [dealers] because that means more freight.” The TransCore North American Freight Index for February increased 65 percent over the prior year. The American Trucking Associations Freight Tonnage Index has improved 15 straight months to reach pre-recession levels.

• Used-truck demand is boosting prices. Treadway said the decline of truck sales over the past three years has resulted in about 70,000 fewer Class 3 to 8 trucks sold in the United States and Canada, while the average equipment age continued to rise in the first quarter of 2011, according to R.L. Polk. A buyer’s definition of what’s an “acceptable” piece of used equipment has changed, he said. With used trucks in demand and harder to find, the average retail price for used trucks has climbed as much as 20 percent in 2010, he said.

• Parts and service business is improving. “At the same time, we saw our parts and service business volume gradually improve,” Treadway said. “The volume was erratic – two good weeks of higher shop capacity, followed by a poor one – but with each month, the good weeks improved and became more consistent. Our customers’ extended replacement cycles finally met the reality of deferred maintenance.”

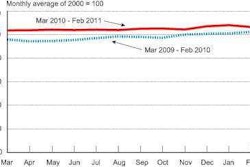

• Truck rental and leasing defies seasonal declines. “The next sign of improved fortunes came in the rental and leasing arena,” he said. “Many dealers saw rental utilization rates defy seasonal declines and hover month-after-month at 90 percent or higher.” Treadway said customers like the flexibility that leasing and rentals provide because of the uncertain economy. “If a ‘double-dip’ recession materialized, they could quickly downsize and minimize their exposure,” he said.

• New-truck orders are increasing. Treadway said orders for new trucks were up in the first quarter of 2011, and manufacturers and suppliers began recalling furloughed workers and expanding and adding shifts. “Some dealers are cautiously recalling workers, resurrecting technician apprentice programs, adding swing shifts and increasing stock levels,” he said.

Treadway cautioned that the economic recovery is not a sure thing and easily could be derailed by volatile fuel prices, an unpredictable regulatory environment, international political upheaval and global disasters. “We need to rebuild inventories, shore up our cash flow, review wage rates and sell some trucks,” he said.

In the legislative and regulatory arenas, Treadway said ATD and truck dealers have an aggressive agenda for the coming year, such as:

• Shaping the nation’s first-ever fuel economy and greenhouse gas emissions standards for commercial trucks;

• Expanding the U.S. Environmental Protection Agency’s SmartWay program to include more fuel-efficient trucks;

• Passage of new highway funding; and

• Introducing federal incentives for new truck sales.

“The need for us to gather together and use our voice is more critical than ever,” Treadway said. “As they say in Washington, if you’re not at the table, you’re on the menu.”

As a first step, ATD has been working with truck dealers all over the country to bring members of Congress to dealerships to discuss how federal legislation affects truck retailing. Last month, Treadway had the opportunity to host both of his U.S. senators when Orrin Hatch and Mike Lee toured his dealership in Salt Lake City. Treadway urged dealers to reach out to their members of Congress and invite them to their dealerships to learn more about the truck retailing industry.