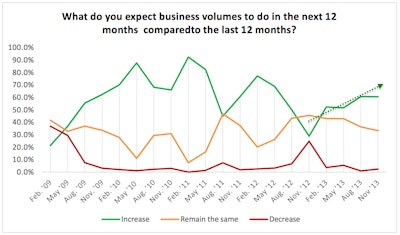

A sense of steady growth in the economy is producing increasingly positive expectations from trucking companies, especially smaller carriers, according to the fourth-quarter business outlook survey by Transport Capital Partners. The survey suggests the slow but upward growth of the economy is moving the freight market to a higher level.

Courtesy: TRANSPORT CAPITAL PARTNERS

Courtesy: TRANSPORT CAPITAL PARTNERSContinuing the positive trends of the previous quarter, more carriers are expressing optimism for increases in volumes and rates. Since the fourth quarter of 2012, positive volume expectations have risen to 61 percent from 29 percent.

With those increasing volumes, a majority of carriers are also expecting rates to climb over the coming 12 months. Almost three times as many carriers are optimistic about rate increases than are pessimistic. Smaller carries (those grossing under $25 million per year) are slightly more positive about rate expectations than are larger carriers, 65 percent compared to 60 percent.

“Volumes and rates continue to be more entwined as positive GDP numbers are laid on top of effective capacity brought down by the FMCSA driving hour mandates,” says Steven Dutro, TCP Partner. “If 5 to 10 percent of driver hours have been reduced in the systems, 5 to 10 percent more drivers are required with higher pay. And in most cases it appears carriers will need to buy more trucks, adding to their fixed costs.”

Despite this optimism, rate and volume growth has yet to fully materialize – aside from the construction, petroleum, and seasonal freight sectors, the survey notes.

Related: End-of-the-year freight activity lived down to expectations in Nov.

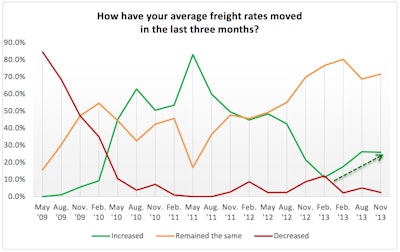

For the past 16 quarters (since February 2010), a majority of carriers have expected rates to increase. However, rates have actually risen only since the first quarter this year. And 72 percent of carriers saw rates remain the same for this quarter. Similarly, more small carriers experienced rate increases this quarter than did large carriers , 36 percent compared to 20 percent.

Courtesy: TRANSPORT CAPITAL PARTNERS

Courtesy: TRANSPORT CAPITAL PARTNERS“Initial carrier contacts and load board reports show strength in spot market rates,” says TCP Partner Richard Mikes. “This, coupled with positive political news in D.C., gives hope for stability in the economy with carrier rate expectations in the survey.”

TCP will release additional 4Q2013 survey results in the coming weeks.

Carriers interested in participating in the Business Expectations Survey, now in its sixth year, should visit transportcap.com/industry-survey for more information.