Click here to download the full copy of CCJ’s 2015 Trucking Outlook report.

“Rates are finally starting to become realistic, and shippers are now becoming willing to pay for the service excellence they demand and expect,” said a survey respondent for a large for-hire carrier.

But for smaller fleets, getting increases in freight rates is tougher. “With all the brokers who get the majority of the freight and charging a one-way rate, it’s hard to compete,” said a survey respondent for a small for-hire fleet. “We have brokers calling us for rates, only to have them undercut us and put it on a board for a one-way trucker to haul at a margin of the rate.”

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report.

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report. The question doesn’t seem to be if freight rates will rise, but rather if they will rise enough to help offset driver wage increases and other organization costs.

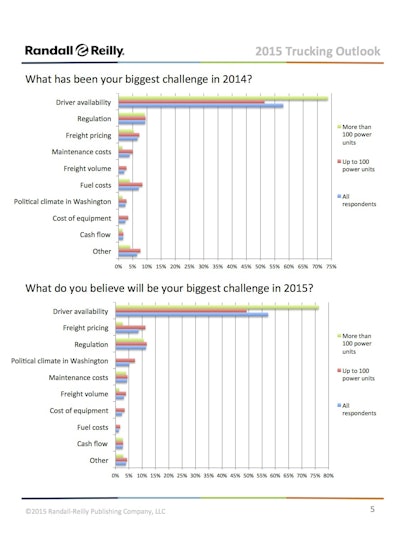

“Fleets need to get paid more, and they know that,” says Broughton. “Right now, most truckers are cautiously optimistic about the pricing power and prospects of improving pricing in 2015. There are more loads than trucks, resulting in tight capacity and great demand. If I’m a fleet manager, I may be concerned with pricing, but that is to say, ‘Am I charging enough, or can I get even more?’ ”

In the spot market, rates continue solid year-over-year growth on a seasonally adjusted basis after hitting what Internet Truckstop said were record levels in June in refrigerated, dry van and flatbed markets. DAT’s rate trends bear out similar results, and the forecast is for continued general strength for spot market rates, at least in the near term.

<