Note: This story is part of an in-depth five-part series on what 2015 holds for trucking companies and what fleet executives see as the industry’s chief challenges. Click here to read from the beginning.

Click here to download the full copy of CCJ’s 2015 Trucking Outlook report.

“The driver is the new customer,” says Broughton. “We have to learn how to not only pay a driver more, but make their working conditions more liveable.”

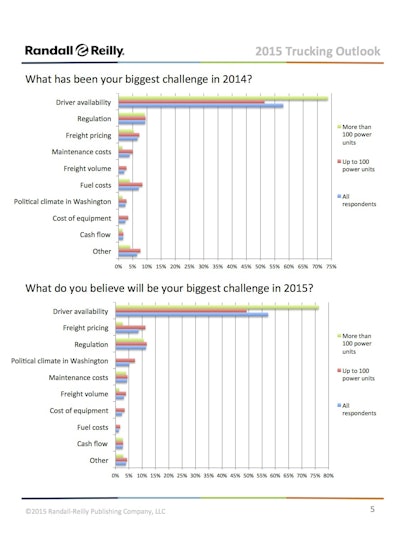

“The driver shortage issue is a double-edged sword,” adds Costello. “On one hand, it is a restraint on capacity. On the other hand, it is an operational nightmare.”

Clearly, raising driver pay is the easiest way to attract new entrants to the industry, and open-ended responses to the survey suggest that many fleets are finding ways to do that.

“The general shortage of available capacity in the trucking industry is a major constraint on shipment growth, but has allowed pricing increases that both allow us to increase driver pay and improve our yield,” said one survey respondent. “Unless fuel prices spike up, I believe our improvement will continue through the year.”

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report.

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report. Fleets across the country are experimenting with new pay structures and incentives, and sign-on bonuses are making a comeback. Some fleets even are reporting double-digit percent increases in driver pay to recruit and retain new drivers.

Meil cautions carriers on the cyclicality of the trucking business and what higher rates might mean in the future. “When you don’t have enough supply, prices go up, and labor prices go up as well,” he says. “With the inherent cyclical volatility of the business, everyone is worried about what [higher driver wages are] going to mean when we get to the stage where the economy weakens and freight softens and suddenly we have a higher wage bill.”

With a steady economy, it’s unlikely the driver shortage problem weakens in 2015, and it will be of particular interest to watch driver pay trends to see how carriers can compete with other industries to grow their businesses.