A look at a few trucking-related economic indicators that came across the wire this week:

[gttable cols=””]

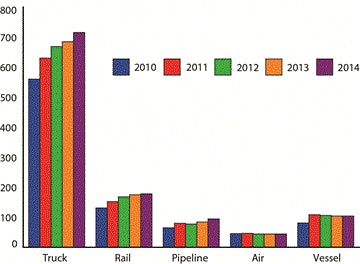

Cross-border truck freight jumped in 2014: The amount of goods carried via truck to and from the U.S. and its North American Free Trade Agreement partners Canada and Mexico rose 4.5 percent in 2014 from 2013, according to data released this week by the Department of Transportation.

The DOT says $1.2 trillion in goods was moved between the U.S. and its NAFTA partners, and trucks carried just shy of 60 percent of that — $715 billion of freight.[/gttable]

[gttable cols=””]

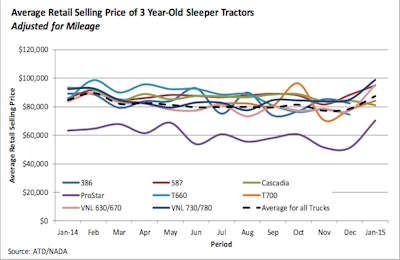

Post-emissions trucks balloon on used truck market: The number of 3- to 5-year-old trucks available on the used truck market has seen an influx of late, according to a report released this month by the National Auto Dealers Association, which says the number of 2011-2013 year-model trucks makes up about 60 percent of used truck availability.

An uptick in new truck orders and trade-ins of used equipment last year drove the increased availability of 2011-2013 year-model trucks, NADA’s report says, though the average price of used trucks in that range, $74,020, is on the high side, NADA says.

But the expected increased truck order activity this year could push more post-2010 emissions standards trucks onto the used market this year and drive their prices down.[/gttable]

[gttable cols=””]

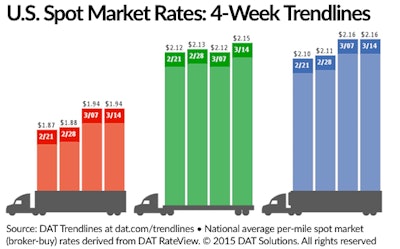

Flatbed rates rally; reefer and van flat: Per-mile spot market rates for flatbed rose 3 cents last week to $2.15, according to DAT Solutions’ weekly rate summary. Van and reefer rates, however, were unchanged, $1.94 and $2.16, respectively. Strong rates in the Southern U.S. drove flatbed’s increase, as rates in the segment grew by 20 cents outbound from Jacksonville, Fla., 8 cents from Tampa, 5 cents from Fort Worth, Texas, and 40-cents on the Houston-Bismarck corridor.[/gttable]