A few trucking economy indicators to come across the wire this week:

[gttable cols=””]

Driver turnover remains sky high: Turnover at large truckload fleets fell one percentage point in the fourth quarter of 2014 to 96 percent, according to the American Trucking Associations’ quarterly report, released April 1.

Turnover at small fleets in the quarter was 95 percent.

For the year, the turnover rate at large truckload carriers was 95 percent, down one percentage point from 2013’s rate. Turnover at small fleets, however, jumped 11 percent to 90 percent.

ATA measures small fleets as those with $30 million or less in revenue annually.

ATA Chief Economist Bob Costello says the numbers point to a worsening driver shortage. “These figures show us that the driver shortage – which we now estimate to be between 35,000 to 40,000 drivers – is getting more pervasive in the truckload sector,” Costello said. “Due to growing freight volumes, regulatory pressures and normal attrition, we expect the problem to get worse in the near term as the industry works to find solutions to the shortage.”

The turnover rate at LTL fleets was 10 percent in the fourth quarter and 11 percent on the year.[/gttable]

[gttable cols=””]

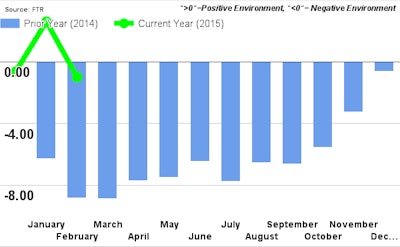

Shippers conditions see uptick from fuel, restart rollback: Conditions for shippers in January saw a boost in January, according to FTR’s monthly Shippers Conditions Index. FTR calls it a “one-month reaction” to declining fuel prices and the temporary suspension of some hours-of-service provisions.

FTR expects conditions for shippers in 2015 to deteriorate as the year goes on, as growing freight and new regulations will constrict capacity and boost rates.[/gttable]