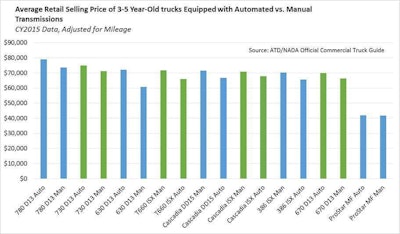

According to data released Monday by American Truck Dealers (ATD), a 10-speed manual transmission still brings in more money than an AMT except in the case of Volvo, whose I-Shift transmission averaged 8 percent more money over a manual when coupled to a D13. Detroit’s DT12 transmission was too new to the market to reflect in the data for Freightliner, ATD says, so Freightliner’s results are represented mainly by the Eaton Ultrashift Plus.

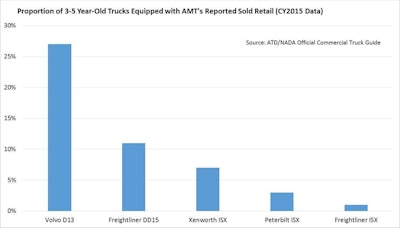

Chris Visser, senior analyst and product manager, commercial vehicles for J.D. Power, says the current industry-wide take rate for AMTs is roughly 20 percent across the board for non-proprietary transmission/engine combinations. A few selected proprietary makes – namely Volvo – approach 90 percent, he adds.

“Looking at volume of AMT’s in the used truck marketplace, that configuration was still the minority in the 3-5 year-old segment,” Visser says. “The [take rate] percentage will accelerate in upcoming years, but it might take another five years or so before half the trucks on dealers’ lots are automated.”

Volvo introduced the I–Shift in North America in 2007, becoming the first truck OEM to bring an integrated AMT to the market. Volvo made the I–Shift standard on all Volvo-powered models in 2013 and I–Shift penetration in North America reached a record 83 percent last year.

A Freightliner equipped with a Cummins ISX, according to the study, was the least likely to be matched to an AMT, while Volvo’s D13 was the most likely.

As for return on investment on the secondary market, ATD data shows a Freightliner equipped with a DD15 and an AMT commanding 6.8 percent fewer dollars than a similarly spec’d 10-speed manual; a Freightliner with a Cummins ISX bringing in 4.8 percent less; an ISX-powered Peterbilt calling for 6.8 percent fewer dollars and a Kenworth with Cummins ISX going for 9.4 percent less.

“Buyers of [Kenworth] models appear to show incrementally less interest in AMT’s at present,” Visser adds.

Volvo’s D13 engine, at 8.1 percent, was the lone engine to gain value when matched to an AMT.