New registrations in the first quarter exceeded the 150,000 unit level for only the fifth time since the 2001 CY.

Class 8 large fleets (operating 501-plus vehicles) had the largest year-over-year decline in new registrations, falling 18.4 percent from the same period last year, continuing a trend that started to materialize during the middle of last year. Large fleets, according to the report, have accounted for around half of all new Class 8 registrations each of the past 5 years. However, large fleets’ share of Class 8 new registrations in the first quarter this year fell to 45.8 percent compared to 50.3 percent during the first quarter last year.

New commercial registrations during the first quarter of the 2016 indicate that all GVWs except Class 8 will equal or exceed the level of activity achieved during last year.

“The level of new registrations of GVW 8 vehicles during the first quarter equate to an annual volume of 221,000 units, down 14.3 percent from the level achieved during the 2015 CY,” the report predicts.

Used trucks accounted for 53.2 percent during the first quarter of this year, the highest level since the second quarter of 2014 when used transactions accounted for 53.7 percent.

Ford, according to the report, remains the leading manufacturer of commercial vehicles thanks to strength in Classes 3-5 with a 28.7 percent share of new registrations during the first quarter of 2016, up from 27.8 percent during the same period last year. Hino (25.1 percent) and Mercedes-Benz (15.3 percent) had the highest year-over-year increase while Volvo (-22.8 percent), Kenworth (-14.6 percent) and International (-14.6 percent) had the largest declines.

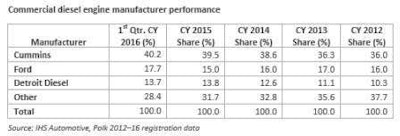

Even with a year-over-year decline in new registrations of Class 8 trucks this year, Cummins increased its share of installations of diesel engines due to a boost from Classes 4-7. Diesel engines accounted for 75.4 percent of new registrations. The increase in Ford’s share of diesel engine installations resulted from a significant increase in diesel engine installations in Classes 5 and 6.