In releasing its 2016 results, NACFE says 17 fleets totaling more than 62,000 tractors and 217,000 trailers that participated in its study saw a 3 percent overall increase in fuel economy in 2015 — the eighth consecutive year-over-year increase — resulting in a savings of nearly $501 million in fuel costs compared to the 2015 national average.

The results are “not only more of the same but a lot more,” says Dave Schaller, NACFE industry engagement director. “Despite seeing fuel prices drop considerably … fuel economy averages are still up.”

NACFE says the 3 percent increase of 6.87 mpg to 7.06 mpg by its fleets was the largest margin of improvement during the recent eight-year increase, and with a trade cycle for the fleets at a little more than five years, NACFE estimates the new trucks in the study are about 16 percent more efficient than the 2010 model year trucks they replaced.

NACFE cites new mandatory vehicle technology, and optional add-on technology at the OEM and aftermarket levels as the reason for the continuing improvements.

“Improvements in both the fuel economy and bottom lines of the leading fleets this year provide a compelling call to action for the rest of the industry,” says Mike Roeth, operation lead for CWR’s Trucking Efficiency and executive director of NACFE. “Investing in efficiency technologies is the new normal. And these fleets are continuing to make investments because they do not want to be caught short when fuel prices go up again.”

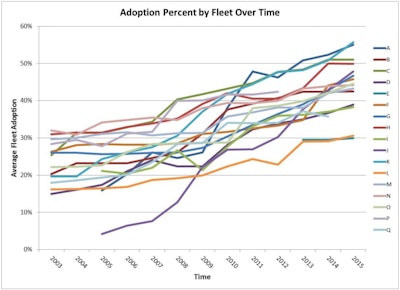

NACFE estimates the investment its 17 fleets have made in fuel efficient technologies are showing a payback of 2.5 years on average. It also says that other than a few exceptions, nearly all of the 69 fuel efficient technologies available in the market today are seeing steady yearly increases in adoption.

Additionally, Roeth says fleets that participated in the study are increasing their adoption of technologies that will likely be required under the new fuel economy and emission regulations released last week.

“There is clearly a need to increase the confidence in and/or payback of many of these technologies for wider-scale use,” he says. “Manufacturers must improve the availability and payback of these technologies to profitably meet the requirements of the final GHG2 regulations.”