The Motus platform helps companies automate the process of tracking mileage and reimbursing employees for business use of personal vehicles.

The Motus platform helps companies automate the process of tracking mileage and reimbursing employees for business use of personal vehicles.Commercial and private fleets have employees that use personal, non-specialty vehicles for work to make sales calls and rush deliveries, among other activities.

Companies often use a standard IRS mileage rate, currently at 53.5 cents, to reimburse their employees, tax-free, for their business miles. Alternatively, a common practice is to pay a monthly flat allowance so as to not burden employees with keeping track of their mileage.

Both methods are a one-size-fits-all solution and that can be risky, especially in the state of California.

The state’s Labor Code Section 2802 states that employees must be reimbursed for all of their expenses to perform job duties. That may seem straightforward, but “employers have the burden to show they are accurately reimbursing employees,” says attorney Danielle Lackey, General Counsel for Motus, which offers a vehicle management and reimbursement platform.

In California, 61 active lawsuits allege Section 2802 violations against employers, she says. One recently settled case was against a marketing services firm, Harte Hanks Inc. The company was found in violation of the law for not parsing out expense reimbursements in its payroll, she says.

The company paid employees that used their personal vehicles for work higher base salaries and higher commission rates, but that was not enough. The company was ordered to pay $7 million to settle the lawsuit.

The least risky method for vehicle reimbursement is also the most accurate. Motus is one of several companies that has developed software that automates the task of using the Fixed and Variable Rate (FAVR) method for reimbursement. The FAVR method uses a calculated rate based on the lifecycle costs for a type of vehicle that is reasonable for the job, not the actual vehicle a worker uses.

A salesperson may drive a Chevy Suburban, for example, but the company can reimburse the employee for the equivalent rate of using a Ford Focus, as a sedan would be a reasonable vehicle to do the job.

Businesses that use a system based on the FAVR method are protected in court, she says, since California and other state laws do not require employers to reimburse for exact expense amounts. They can use the cost inputs for a vehicle that is reasonable to do the job, but all of this has to be well documented.

“The data is becoming central to withstand and respond to inquiries,” she says.

The Motus platform automates the FAVR method by breaking down fixed and variable costs of a chosen vehicle into six components that include depreciation, maintenance and fuel costs. The cost of fuel is based on the zip code of where the employee is located.

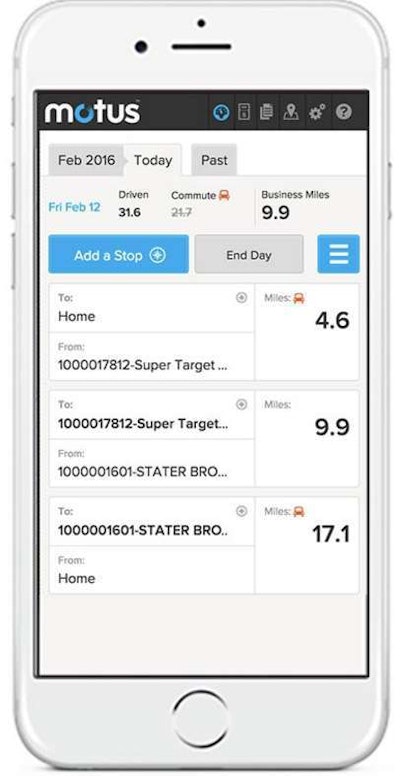

Rather than install a telematics device to track personal and business use of the asset, companies that use the Motus platform have their employees download an app on personal smartphone or tablet devices.

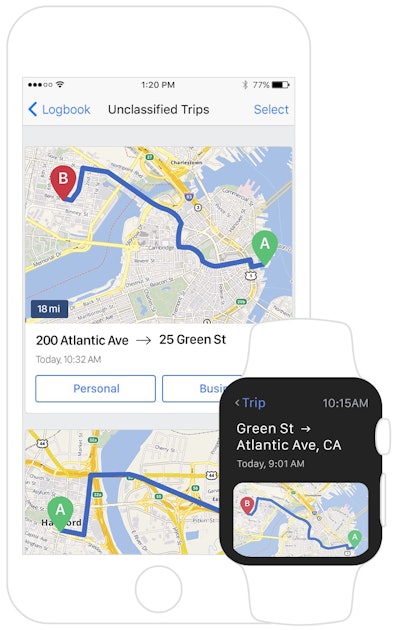

The Telogis Logbook app enables users to track business use of their personal assets.

The Telogis Logbook app enables users to track business use of their personal assets.The Motus app can automatically capture GPS mileage during work hours. Employees can also manually start and stop each business trip, and can make adjustments between business and personal use of their vehicle as needed.

Telogis, a Verizon company, offers an app called Logbook that supports commercial drivers, mobile sales reps, supervisors and field workers that drive a vehicle for both personal and business use. The Logbook app makes it simple to classify mileage as either personal or business, the company says.

Users can label, organize and classify trips by business purpose by swiping their mobile device. Supervisors can administer classified miles, assign unclassified trips to individual drivers and generate private-versus-business mileage summaries and detailed reports for tax reporting.