Craig Fuller, founder and chief executive officer of TransRisk, believes that any impact to rates from the ELD mandate may not be seen until March, 2018. He attributes this delay to enforcement being handled differently in each state. Even so, true enforcement may not happen until insurers require carriers to provide proof of ELD compliance to renew policies, he says.

Fuller has a vested interest in rates becoming volatile from ELDs and other factors. He founded TransRisk to offer a first-of-its-kind trucking futures market to shippers, brokers and carriers to hedge their risks from rate volatility.

Similar to futures and derivatives markets in other industries, TransRisk will offer contracts that will be financially settled rather than exchanged for actual goods or services.

“A truck will not show up at your door because you bought a future (contract),” he says.

Fuller got the idea for TransRisk in 2014 while consulting a high-tech brokerage firm and day trading on the side. He researched a futures market for maritime transportation called the Baltic Exchange to serve as a model for TransRisk.

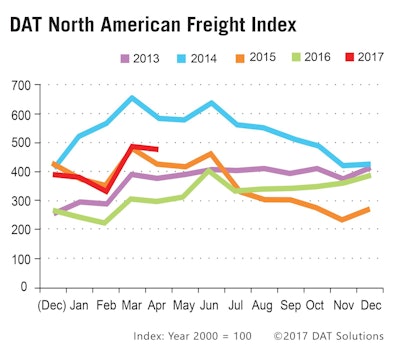

TransRisk will provide rate data and information to its market participants. From what Fuller has seen so far from data the company gets from DAT Solutions, rates in the spot market are “slowly but surely coming back up” yet there has not been any volatility caused by ELDs.

Anecdotally, carriers that implement electronic logs typically lose between two and six percent utilization, he says. Even if the overall trucking industry were to lose two percent of its total capacity in the next 12 months, Fuller predicts the impact to rates would be minimal.

Overall, Fuller predicts trucking capacity could decrease by a “couple percent” in 2018 if a small segment of the industry, primarily small fleets and owner operators, lose their profit margins if they fully comply with hours-of-service regulations.

The true impact of the ELD rule will be difficult to gauge, he says, because so many other economic variables could play a factor in 2017 and 2018 such as growth in e-commerce, changes in trade policy, government spending and more.

The signs are starting to appear that rate volatility could begin ahead of the Dec., 2017, mandate. In May, Walmart sent a letter to the motor carriers and third party logistics (3pl) providers participating in its annual bid.

In the letter, the retail giant noted that a “high variance in rates” were submitted for its truckload bid. In response, the company announced it would invite additional, non-incumbent parties to participate in a third round. Historically, Walmart has only conducted two rounds of bidding before awarding lanes.

The Walmart bid may show signs that carriers are re-evaluating their rate structures because of ELDs. It also shows that Walmart and other retailers are under enormous pressure to drive more rate compression to compete with the fast growth of Amazon in e-commerce.