Transportation companies are finding new ways to scale their businesses without having to invest in equipment and facilities.

Technology is fueling a growth in nonasset transportation and logistics by helping companies solve more complex problems for their customers and increasing the efficiency and speed of freight transactions.

Whether or not a transportation company has its own fleet, it can expand its value to shippers by providing seamless visibility of all freight no matter whose assets are powering the loads.

Many other capabilities are making it possible for asset and nonasset transportation providers to grow and increase margins more rapidly in today’s freight environment.

Predictive freight matching

Some of the companies that provide freight tracking systems have developed freight-matching services that use historical and real-time locations and other data to predict where and when capacity will be available in the carrier network of a 3pl or freight broker.

Trucker Tools’ Smart Capacity predictive freight-matching platform uses the company’s smartphone app that drivers use for trip planning.

Trucker Tools’ Smart Capacity predictive freight-matching platform uses the company’s smartphone app that drivers use for trip planning.Trucker Tools last year announced its Smart Capacity predictive freight-matching platform. After watching a demonstration in January, mid-size 3PL Triple T Transport gave the product a try.

The technology uses Trucker Tools’ smartphone app that drivers use for trip planning. Triple T wanted to increase the probability that its preferred carriers would stay connected to the platform to find loads.

Owner-operators and drivers for small carriers use the app to match freight from Triple T and other 3PLs. This solution works better than if Triple T had its own app, said Darin Puppel, president of the Columbus, Ohio-based company. “Carriers do not want to use a multitude of different apps to find a load,” Puppel said.

Triple T gets freight-matching recommendations on a map by logging into Smart Capacity’s web portal.

“We wanted a platform where our preferred carriers give us the first shot at matching loads with them,” he said. “Smart Capacity allows us to effectively work further into the future, increasing the probability of booking with our preferred carriers before they start looking for loads from others.”

Instant pricing

Freight brokers and third-party logistics providers are earning more business by providing shippers with instant pricing and booking tools for spot-market freight movements.

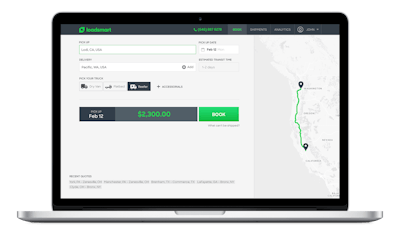

LoadSmart developed algorithms that predict rates to offer shippers instant booking options for their freight.

LoadSmart developed algorithms that predict rates to offer shippers instant booking options for their freight.Such a strategy was used by LoadSmart, a high-tech freight broker that specializes in full truckload shipping. The company developed a digital platform and proprietary machine-learning technology that instantly predicts carrier rates to offer shippers instant pricing and “book it now” options for up to four days in advance.

LoadSmart’s machine-learning algorithm predicts the price of capacity by lane, says Felipe Capella, the company’s co-founder. About 60 percent of its customers’ orders are instant “book it now” options, Capella says.

The pricing algorithm uses data inputs from public sources such as weather databases and private sources such as factoring companies that provide carrier rate data.

By using the LoadSmart platform, Daimler Trucks North America has reduced the time it takes to complete spot-market arrangements for its manufacturing and aftermarket truck parts business from five hours a day to an average of 18 minutes a day, Capella says. LoadSmart is on track to manage 100 percent of DTNA’s spot-market freight transactions, he says.

Some carriers that buy Daimler trucks also haul freight for the truck maker. To give these truck-buying customers a first preference for Daimler’s loads, LoadSmart has customized some features of its online platform to identify the assets of these “VIP carriers” that are positioned to move loads for the OEM.

Carriers that do business with LoadSmart provide notification of their available capacity in various ways, such as by email. LoadSmart captures shipment-tracking data using its mobile app and by integrating with telematics systems. The broker pays carriers within two days after delivery.

Freight visibility

Penske Logistics’ ClearChain technology suite is designed to provide visibility to its customers by connecting all parts of their supply chains, says Joe Carlier, the company’s senior vice president of global sales.

Penske Logistics’ ClearChain technology suite is designed to provide visibility to its customers by connecting all parts of their supply chains, says Joe Carlier, the company’s senior vice president of global sales.Many technology companies have developed systems that automatically locate shipments using cell-tower signals, GPS from drivers’ phones and telematics. While these systems eliminate manual “check calls” to drivers to update the status of loads, this is only the start.

Some logistics providers also use this automated tracking technology to give shippers visibility to all of their freight in their supply chain.

While Penske Logistics uses commercially available technologies, the company also has taken additional steps with its ClearChain technology suite designed to provide visibility to its customers by connecting all parts of their supply chains.

The suite organizes its customers’ data into an easily accessible repository that drives efficiency, cuts costs and manages service disruptions, the company says.

ClearChain provides status updates using GPS tracking to see carriers’ locations at any point. If a carrier doesn’t have an onboard tracking system, Penske can connect with the driver’s cellphone. The suite also can monitor real-time traffic and weather information along routes and near customers’ locations to provide more accurate arrival time estimates.

“The ClearChain technology suite, coupled with the people and processes behind it, allows users to know what is happening at the touch of a button or click of a mouse or tap of a finger or swipe of a card,” says Joe Carlier, senior vice president of global sales for Penske Logistics. “That knowledge creates better service and results.”

Freight payments

With the mobile connectivity options used by freight brokers and carriers to capture arrival and departure events and proof-of-delivery documents, more brokers and 3PLs are working to provide carriers with a seamless invoicing and payment experience.

FR8Star – a freight broker that specializes in oversize, overweight and open-deck loads – is using the Comchek Mobile system to issue fuel advances to carriers at the moment of pickup and to pay in full as soon as carriers upload images of delivery documents.

Users can register for Comchek Mobile, a peer-to-peer digital payment system, as an individual or business owner. The latter registration comes with reporting to track spending for general ledger accounting and auditing, says Terrence McCrossan, senior vice president for Comdata North American Trucking.

By using the technology, freight brokers do not have to collect and store bank account information for deposits. Instead, brokers only need a carrier’s Comchek Mobile ID number to send funds for payment, McCrossan says.

Every month, about 5,000 owner-operators and small-fleet drivers download the Comchek Mobile app from Google Play or the Apple App Store, he says.

Freight marketplaces

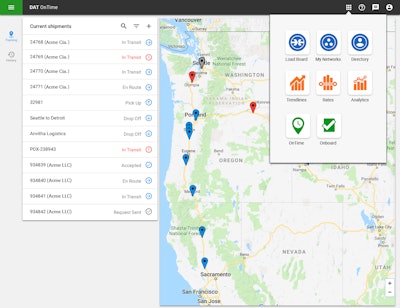

DAT is working to make tracking easy for all to use, says Eileen Hart, the company’s vice president of marketing and corporate communications. The company’s OnTime load tracking is integrated with a variety of solutions in the DAT portfolio.

DAT is working to make tracking easy for all to use, says Eileen Hart, the company’s vice president of marketing and corporate communications. The company’s OnTime load tracking is integrated with a variety of solutions in the DAT portfolio.While some freight brokers have developed their own technologies to automate the process of matching loads with available trucks, the vast majority continue to use freight marketplaces to find capacity.

Forty years ago, DAT created the original load board to connect brokers and 3PLs with carriers to conduct spot-market freight transactions. Today, more than 637,000 loads are posted every business day through the DAT marketplace, and the load-to-truck ratios currently are at record highs.

More carriers are using DAT to take advantage of pricing opportunities, as can be seen by the record growth in carrier subscriptions in January, which were 59 percent more than January 2017, says Eileen Hart, the company’s vice president of marketing.

Over time, DAT has evolved from being a static load board to a dynamic freight marketplace with technologies that cover the full spectrum of a freight transaction. During the past nine months, DAT has focused on creating “seamless” freight-matching and connectivity services for carriers, says Neerav Shah, the company’s vice president of products.

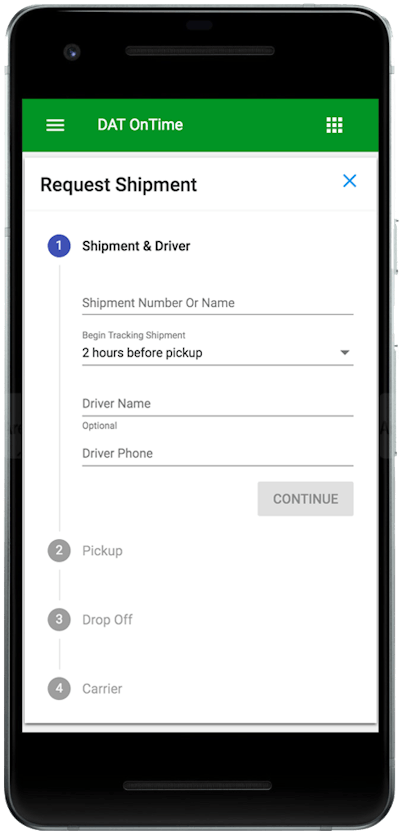

Once a carrier books a load, brokers can message the driver’s smartphone and automatically track loads by using a DAT app or an integration with the truck’s electronic logging device, Shah says.

DAT also is developing a suite of cloud-based apps that drivers and carriers can use for specific functions such as document capture, searching for loads and rates and more. These apps also will have data-sharing functions, he says.

DAT also is investing in new user experiences for carriers, such as mobile apps that carriers can use to automate communications with brokers to find loads and get paid faster. “We understand that people want to put technology in their hands,” Shah says.

TMS flexibility

Freight transactions can be more complex than simply matching loads with available trucks. To achieve the best possible outcomes for price and customer satisfaction, freight brokers and 3PLs can use advanced software systems that consider all types of transportation modes and routing options.

Shipment is a simple screen that shows how easily loads can be created and managed in the DAT system from any device, says Neerav Shah, the company’s vice president of products.

Shipment is a simple screen that shows how easily loads can be created and managed in the DAT system from any device, says Neerav Shah, the company’s vice president of products.The 3Gtms software system, used primarily by freight brokers and 3PLs, has a feature known as “continuous pool optimization” that “allows us to address a surprising number of very interesting and challenging things that people are doing,” says Mitch Weseley, the company’s chief executive.

“The whole premise of the TMS world, going back to the beginning in the 1980s, was to let people be creative and dynamic,” Weseley says. “Static decision making is very cost-inefficient.”

The continuous pool optimization feature identifies the best pool point in a company’s freight network, such as a warehouse or cross dock, to route a daily mix of inbound freight, both truckload and less-than-truckload, to plan loads for delivery more efficiently.

In addition to pooling, 3Gtms has other advanced optimization features that both asset and nonasset transportation companies can use to offer dynamic solutions to their customers and prospects, Weseley says.

“Brokerage software is not just about connecting A and B,” he says. “The direction of the industry is to create more options and dynamics to take advantage of where things are in a particular point in time.”

Whether transportation companies have their own equipment or source capacity from third-party carriers, the ones that are succeeding in this environment are bringing information together from different sources and solving problems at an unprecedented scale and speed.