Connecticut could be the next state to pursue a trucks-only tolling plan to drum up revenue.

Democrat Ned Lamont, who was elected as the state’s next governor last week, said during his campaign he intends to propose trucks-only tolls in the state to curb what is projected to be a multi-billion-dollar budget deficit by 2021.

However, the state’s trucking association, with backing from the American Trucking Associations, says it intends to fight any trucks-only tolls should Lamont follow through on his campaign promise. Joe Sculley, president of the Motor Transport Association of Connecticut, said tolls on trucks in the state “could double our tax burden overnight if it raises the money he’s talking about.” Targeting out-of-state trucking carriers “is going to be a clear violation of the Constitution’s commerce clause,” he added.

In an interview with Connecticut’s Journal Inquirer, Lamont said truck tolls could raise $250 million per year, adding that offering truckers a discount during off-peak traffic hours could help keep truckers off the highways during rush hour. The Connecticut Post reports Lamont predicted the tolls could generate $100 million per year. Without an official plan, it is unclear how much Lamont plans to charge trucks to drive through the state or how much money could actually be generated from the tolls.

The governor-elect says on his website he supports tolling of out-of-state trucks because they “use our roads toll-free and create significant wear-and-tear.”

Sculley refutes Lamont’s assertions about out-of-state trucks. Fuel taxes, registration fees and other fees required of carriers help pay for their use of roads, he says. However, he said a sit-down with the governor-elect could help educate Lamont on these costs. However, says Sculley, Lamont did not grant MTAC’s request for a meeting.

“We are still asking for a chance to sit with him and talk about the complex taxation and regulations we deal with,” Sculley said. “I’d say those comments are obviously incorrect, but unless you’re in trucking every day, we shouldn’t expect someone to know. There’s nothing to be ashamed of because you think out-of-state trucks come through the state for free. A lot of people think that.”

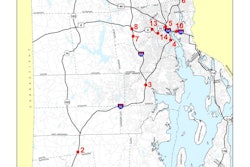

Rhode Island just this year enacted a broad trucks-only toll system, which was first proposed in 2015. However, the state is facing a stiff legal challenge by the Rhode Island Trucking Association and ATA, who’ve sued to have the plan overruled by the courts. The Rhodeworks system charges trucks at toll gantries along I-95 in $3.25-$3.50 increments, with a one-way through the state trip costing as much as $20 a day. A roundtrip would cost $40 a day. Not all of the gantries are established yet, but Rhodeworks is projected to bring an additional $1 billion in revenue to the state over a 10-year period.

Indiana likewise this year boosted tolls on trucks traveling along its so-called Indiana Toll Road. The state’s governor, Eric Holcomb, in September announced a toll hike of 35 percent for Class 3 and higher trucks traveling on tolled stretches of I-90 and I-80. It’s also expected to raise more than $1 billion in revenue for the state. Trucks traveling along the Indiana Toll Road could pay as much as $60 a day in tolls.

ATA President and CEO Chris Spear in late October said his group intends to be aggressive against any states that enact trucks-only tolling plans. He specifically cited Connecticut’s plan as a target for legal action by ATA. He called trucks-only tolls “flawed and potentially contagious policies that could eventually have national implications,” and added that “ATA has an obligation to flank our state association executives.”

“It’s ATA’s intention to ramp up its litigation center and leverage our full ability to influence outcomes,” he said.

Lamont has reportedly said he’ll wait for the outcome of the pending lawsuit against Rhode Island’s plan before taking action. ATA’s lawsuit claims Rhode Island’s RhodeWorks plan discriminates against interstate trucking companies and is unconstitutional, given that it “impedes the flow of interstate commerce.”