CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

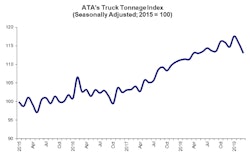

Market conditions for trucking companies continued to sour in February, according to FTR’s monthly Trucking Conditions Index. The index fell to its lowest reading since August 2017, reflecting weaker economics surrounding freight volume and the rate environment for carriers, FTR says.

The index in recent months has moved to a more neutral position, where FTR expects it to remain throughout 2019 and into 2020. However, the index has inched “close enough to neutral that negative TCI readings are now a possibility,” should market conditions deteriorate further, says Avery Vise, FTR’s vice president of trucking.

“We continue to see modest weakening in trucking conditions due to the near-term easing of freight rates and volumes, but we should remain generally above neutral during the coming year,” he says.

The index roared upward in early 2018 as freight volumes climbed and trucking capacity maxed out, causing rates to spike to record highs last summer. Late in 2018, however, the market began to cool, causing the index to begin to slip into more neutral territory.