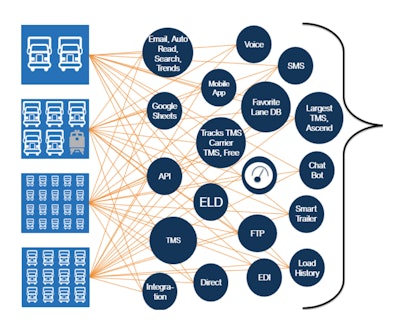

This illustration on Cargo Chief’s website shows the many different options for carriers to share lane preference data for matching available freight from brokers.

This illustration on Cargo Chief’s website shows the many different options for carriers to share lane preference data for matching available freight from brokers.Cargo Chief, formerly a tech-enabled broker that has since sold off that part of its business, announced the release of the latest version of what it calls its C4 platform — version 2.0 it pitches to brokers as “the most complete and informative database of trucking carrier lane preferences and availability in the OTR (over-the-road) industry.”

Utilizing a myriad of sources for the carrier-provided data it makes available to brokers to save time in the process of matching with carriers on available loads, C4’s 2.0 platform, says company CEO Russell Jones, hopes to make good on that goal. Simply put, reducing the number of phone calls for both sides of the transaction and “quickly identifying the top carriers best positioned for a load.”

Jones came to the truckload world via a previous business the tech entrepreneur started in headsets, where he experienced difficulty arranging transport. After launching Cargo Chief some years ago amid a profusion of similarly-focused tech-enabled brokerage businesses, Jones and company ultimately saw a potentially greater value in their data-heavy platform to other brokers. “We wanted to grow our C4 network very quickly,” he says, so “we unencumbered ourselves of being a broker” and sold Cargo Chief’s book of business to another broker.

The relationships it made with carriers as a broker, however, continued when it comes to lane-preference and other data, Jones says. “When we were a broker ourselves, we established relationships with 5,000 carriers there.”

Today, when a new broker comes onto the C4 platform, if the broker wants to see the carriers it has relationships with on the platform, the broker supplies the contacts and “we reach out to the carriers on behalf of the broker,” Jones says.

There are a myriad ways carriers can communicate and/or update their availability and/or lane preferences and overall capacity, whether one truck or hundreds more. If the system is working as intended, lane-preference information then guides what brokers utilizing the system see when they’re looking to move a particular load along a particular lane.

“We’re really accelerating the ability for the broker and carrier to find a match faster,” Jones says, calling it “matching on steroids.” Brokers can utilize C4, too, to help cement relationships with carriers already in their network, and vice versa, with views of those they’re already connected with, versus those haven’t, relative to a particular load’s lane, type and timing.

As with other matching services, the C4 platform enables a carrier generally to broadcast availability to a wider network of potential freight sources, yet Jones believes the multifaceted methods of info and preference sharing available in C4 distinguish it. He hopes that makes it “easy for the carrier to do business with us,” he says, adding: “it’s also free for the carrier.”

The C4 route and lane intelligence database is also driven in part by integration data from transportation management systems (including particularly the Ascend TMS), ELDs, and “surmised data from load histories” from matches made in-platform, the company says.