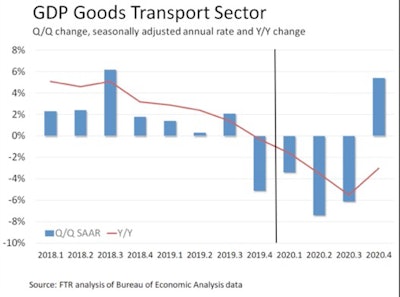

FTR’s predictions for the drop-off in the goods transport sector — and a potential late-year rebound — for the coming quarters.

FTR’s predictions for the drop-off in the goods transport sector — and a potential late-year rebound — for the coming quarters.The spot market over the past week has hit an historically unprecedented surge as shippers scramble to move loads bound for restocking retailers like grocers and Walmart and Target after last week’s panic buy over the COVID-19 coronavirus outbreak.

Once that surge levels off, however, the industry should brace for a sharp recession, said analysts from FTR on Thursday. Jonathan Starks, chief intelligence officer of the transportation forecasting firm, says GDP is forecasted to shrink by 0.7% in the first quarter, then -1.2% in the second and third quarters of this year. He referred to those economic losses as a “serious, but not catastrophic recession,” but noted that the situation regarding the virus outbreak is fluid. “Every day things happen that we didn’t think could ever happen. There are lots of X factors,” said Starks.

In short, said Avery Vise, FTR’s vice president of trucking, “this is going to be ugly. It’s going to be a recession.” Vise says the market could hit “something of a V-shape,” and potentially bounce back later this year.

Click here to view our full coverage of the coronavirus' impact on the trucking industry from the leading industry publications of Commercial Carrier Journal, Overdrive, Truckers News and Trucks, Parts, Service.

Starks said he anticipates a recovery period beginning in the fourth quarter, “of course from a lower level” than the current state of the economy. Upside potential for a later rebound include bailouts and stimulus spending from Washington and a shorter-than-anticipated period of impact of the virus outbreak. “But the downside risks are twice as likely as the upside” potential, he said.

Moreover, the impact on freight demand could be much worse than the losses in GDP, Starks said. FTR forecasts declines of 7.4% in the second quarter and 6.4% in the third quarter for the goods transport sector of the economy.

Retail surges in consumer goods have driven strong freight volumes this month but those levels will be unsustainable as shoppers fill their stockpiles and remove themselves from the market later on. Further, retail activity on anything other than food and cleaning products is practically non-existent and isn’t forecast to improve in the near term.

One area already being severely impacted and likely to continue so, said Jim Nicholson, vice president of carrier sales and operations for Loadsmart, is the auto-hauling sector. Carriers heavily reliant on hauling parts for automobile production have reported “rapid deterioration in truckload volumes,” he said, and they’ve been looking to diversify and potentially take advantage of the replenishment boom in reefer and dry van hauling.

“In the short term, they can take advantage of the trends in the spot market,” he said, but longer term, as their auto contracts wind down and the spot market tension eases, “it’s a challenging environment to operate in.”

Likewise, import volumes at ports are way down, due to loads from China being stalled from the coronavirus outbreak there that began in January. He predicts import levels from China won’t rebound until the third quarter, given the time it will take for the Chinese economy and production to find its footing.

A worldwide shortage of shipping containers, many of which are awaiting unload across the globe under mandatory quarantine or are still floating offshore, is a further drag on import levels and contributing to the decimation of fleets that operate in and around U.S. ports.

Freight volume outbound from Mexico is strong but elevated by shippers apprehensive of potential border closings. The U.S.-Canada border has been closed to all non-essential travel but is open to trade. There is no quarantine for truck drivers and freight is flowing normally as nearly 50% of the food Canadians consume comes from the U.S. and Canada depends on the States for approximately 75% of its exports.

For now, Nicholson said, the spot market is outpacing demand of early 2018, one of trucking’s historically strongest periods of growth. Soaring load availability is absorbing the capacity added in 2017 and 2018. Trucking could ride the current domestic surge “well into the second quarter,” he said, but the recessionary environment brought on by the suddenly stalled economy could cause some pain, especially for carriers in heavily exposed sectors, he said, like automotive and drayage and in manufacturing.

Like Starks, Nicholson said much of the economic outlook depends on the containment of the COVID-19 outbreak both domestically and abroad.

Note: This story’s headline originally said the COVID-19 outbreak has put the economy in a recession. However, recessions are defined as two consecutive quarters of declining GDP or a decline in a mix of general economic indicators like employment, GDP, income, production, etc., sustained for several months. The article’s headline has been updated to reflect that analysts predict a recession is imminent in the coming quarters.