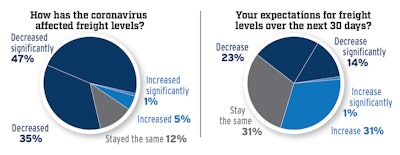

Compared to the week prior, carriers were slightly more optimistic in their outlook for freight demand last week, with 32% of carriers expecting freight demand to increase in the coming 30 days, compared to just 25% the week before. Survey data is based on 225 fleet respondents, ranging in size from 10 trucks to those with more than 1,000.

Compared to the week prior, carriers were slightly more optimistic in their outlook for freight demand last week, with 32% of carriers expecting freight demand to increase in the coming 30 days, compared to just 25% the week before. Survey data is based on 225 fleet respondents, ranging in size from 10 trucks to those with more than 1,000.Class 8 truck orders plunged for the second consecutive month in April, hitting an unprecedented level of 4,000 units, according to preliminary data released Tuesday by FTR.

April order activity reached its lowest point in nearly a quarter-century, coming in 44% below March and 73% lower than a year ago. Class 8 orders for the last 12 months total 160,000 units.

Predictably, fleets have delayed plans for new trucks until the economic uncertainty spurred by the COVID-19 crisis settles. FTR Vice President of Commercial Vehicles Don Ake noted many carriers who already had trucks on order have cancelled a “significant number” of them.

More than 40% of fleets responding to a weekly CCJ survey that measures the coronavirus’ impact on motor carriers said they have cancelled truck (24%) and/or trailer (19%) orders since the pandemic’s onset. That number has held fairly steady since jumping from 19% to 39% from week one of our survey to week three.

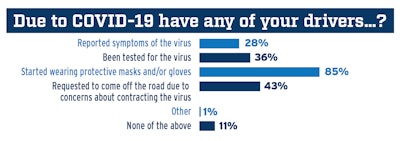

More than a third of carriers reported that some of their drivers had been tested for COVID-19, while more than a quarter said drivers had reported symptoms. 43% of respondents said drivers had asked to come off the road due to concerns about catching COVID-19.

More than a third of carriers reported that some of their drivers had been tested for COVID-19, while more than a quarter said drivers had reported symptoms. 43% of respondents said drivers had asked to come off the road due to concerns about catching COVID-19.“We self-fund all equipment purchases,” wrote one carrier survey respondent. “We are the lender. We canceled new trailer purchases in a move to negotiate lower pricing.”

ACT’s President and Senior Analyst Kenny Vieth noted April was the lowest Class 8 order month since September of 1995, “which actually produced a negative net order number,” but added not all the trucks removed from the April pipeline were cancelled and could be built eventually.

“We suspect that, as was the case in March, instead of cancelling, order holders are content to move orders from close-in to later build dates,” he said, “as they analyze the ongoing COVID impact.”

Fleet executives, get the insider take on transportation disruption.

CNBC’s Donald Broughton will discuss coronavirus effects on freight demand, why tariffs are terrible taxes and using predictive analytics — during our free, virtual CCJ Symposium on May 27-28. Get Details.

“The industry received a shock right along with the economy due to the virus response. Fleets will remain extremely cautious going forward, but we expect orders to modestly increase as the freight markets recover,” Ake said. “We have already seen some signs of life in refrigerated freight and expect improvement in dry van freight soon. The industry recovery will begin in May, but it will be gradual, just like the overall economy.”

For the third consecutive week, the number of carriers reporting a drop in freight volume settled just over 80%. As many states begin the process of opening up their economies, the number of carriers seeing a load increase the week ending May 2 dropped 2%, but those noting volumes remained the same from the week prior climbed 2%, signaling the weekly losses of loads could be leveling off.

“Regular customers have begun to ship some product,” wrote a for-hire carrier with up to 50 trucks. “Other customers beginning to work toward opening, so future is starting to look up.”

“The current week seems destined to improve 10% to 15% over last week so there seems to be some signs of life out there,” wrote another carrier.

More than 30% of surveyed carriers expect load count to increase in the next 30 days, while the number expecting a decrease fell 8% – the largest level of optimism by a wide margin since CCJ‘s survey debuted six weeks ago.

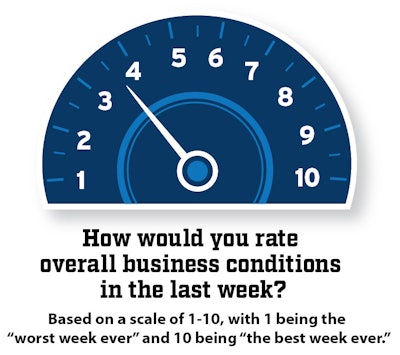

The gauge of business conditions reported by survey respondents jumped this week to 3.58 — meaning carriers reported conditions were stronger last week than in the three weeks prior.

The gauge of business conditions reported by survey respondents jumped this week to 3.58 — meaning carriers reported conditions were stronger last week than in the three weeks prior.“As business slowly starts up again, there will be capacity issues in the supply chain and we are ready for it,” penned a private carrier with up to 250 trucks. “We may be at the bottom right now through the next couple of weeks,” added another. “Since some states are starting to reopen in May, we feel the second half may start to see load activity pick up, which would be highly welcomed.”

A for-hire carrier with up to 500 power units said they expect the biggest impact over the next two weeks will come from the spot market as contract customers start to re-open their doors. “After that, then tenders should be going out as normal,” they wrote. “We believe normal isn’t what we saw in March, but what freight has been doing over the past two years.”

“I expect more freight next week will be customer driven, and relying less on 3rd party,” added another for-hire carrier with up to 50 trucks.

While optimism is starting to bubble, carriers expect COVID-19 to impact day-to-day trucking operations through the summer, scoring it a 6.5 on a scale of 1 to 10, where 1 is minimal impact and 10 is significant impact. Much of that concern is tied to a recovery that is likely to be slow and fraught with hiccups and consumer buying habits that may be forever changed.

“We may see a short spike for two or three weeks somewhere ahead as companies right size their inventories again,” wrote one carrier. “Afterwards, it is likely to flatten out again but it will be tougher to find the most ideal loads and improved rates, except those under contract.”

“Consumers will continue their online shopping habits, leaving a long-term increase in small package freight,” added a private carrier with up to 500 trucks. “May be reduced if businesses do not reopen and wallets tighten significantly.”

More than half (51%) of all surveyed carriers reported laying off personnel either through a reduction in driver count (28%) or non-driving staff (23%). That figure is in line with data compiled from each of the last four weeks, but down 10% from the week prior.

“Although I have not let any drivers go, I am not hiring new ones if they choose to exit the company,” wrote a for-hire refrigerated carrier with up to 100 trucks.

Nearly 20% of respondent carriers say they have taken advantage of payment deferral programs on truck notes and leases.

Nearly two-thirds (65%) said they had applied for a Paycheck Protection Program (PPP) loan, and nearly half of all respondents (48%) said they had been approved for a PPP loan.