Trucking news and briefs for Wednesday, June 30, 2021:

ATA, OOIDA decry new VMT tax law in Connecticut

Beginning in 2023, all vehicles weighing more than 26,000 pounds will be required to pay a vehicle miles traveled tax for every mile driven in Connecticut.

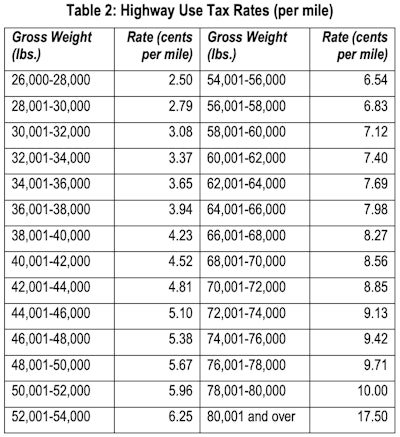

The fee will range from 2.5 cents per mile for trucks weighing 26,000-28,000 pounds to 17.5 cents per mile for vehicles weighing more than 80,000 lbs.

Beginning Jan. 1, 2023, Connecticut will charge truck owners between 2.5 and 17.5 cents per mile for every mile traveled in the state.

Beginning Jan. 1, 2023, Connecticut will charge truck owners between 2.5 and 17.5 cents per mile for every mile traveled in the state.

As expected, the new law is not popular within the trucking industry. In an op-ed for the Greenwich Time, American Trucking Associations President and CEO Chris Spear said the new law “will have devastating consequences for businesses and families across Connecticut.”

“It doesn’t require a Ph.D. in economics to understand that when the cost of truck transportation goes up, the price of what’s being hauled does, too,” he said. “Everyday consumers and the working people of Connecticut will feel the sting of [Gov. Ned] Lamont’s truck tax with each purchase of groceries, gasoline, prescription drugs, construction materials, home furnishings, household goods and so on.”

Spear added that truck taxes such as this are “difficult to enforce and easy to evade, rewarding bad actors and punishing the good.”

Similarly, the Owner-Operator Independent Drivers Association has also lambasted the law.

“We are extremely disappointed in the anti-trucking attitude and determination to raid the bank accounts of some of the hardest working people on the planet,” said OOIDA President Todd Spencer. “Big trucks – especially out-of-state trucks – make for an easy target, and unfortunately the governor and elected officials have picked up on that.”

The infrastructure required to fairly and accurately implement a VMT will likely be both cumbersome and expensive. ATRI found that replacing the national fuel tax with a VMT tax, which would be assessed on 272 million private vehicles, could result in collection costs of more than $20 billion annually – about 300 times higher than the federal fuel tax. Hardware costs alone (mostly attributable to providing motorists with a GPS-enabled device) could have an initial price tag of $13.6 billion and require ongoing replacement. Telecommunications costs would be approximately $13 billion annually, and account administration would be an additional $4.3 billion each year, ATRI estimated.

As far as a truck-only tax, it might not even be legal depending on how those miles are tracked. A driver's ELD can only be used to keep track of hours of service compliance, meaning the state would potentially need to provide whatever device it requires of drivers to calculate their VMT.

Cummins acquires 50% stake in Rush’s nat-gas tech business

Cummins and Rush Enterprises have signed a Letter of Intent for Cummins to acquire a 50% equity interest in Momentum Fuel Technologies from Rush Enterprises. Terms of the deal were not disclosed, and the proposed transaction is expected to close later this year.

The joint venture will produce Cummins-branded natural gas fuel delivery systems for the commercial vehicle market in North America, combining the strengths of Momentum Fuel Technologies’ compressed natural gas fuel delivery systems, Cummins’ powertrain expertise, and the engineering and support infrastructure of both companies.

“This collaboration shows Cummins’ continued commitment to natural gas powertrains,” said Srikanth Padmanabhan, president of the Engine Business at Cummins. “This partnership will improve customers service for both CNG and RNG through an improved support network. We are thrilled to expand our network of clean and reliable power solutions.”

The collaboration will also offer aftermarket support through Rush Truck Centers dealerships and Cummins distributors, which will be able to service both the engine and the fuel delivery system.

Protect your cargo over extended holiday weekend

Cargo theft recording firm CargoNet is warning truck drivers, fleets and others in the trucking industry about increased cargo theft activity during the July 4 holiday period, which runs from July 1 through July 7.

To help supply chain professionals craft strategies to mitigate theft, CargoNet reviewed theft data between July 1 and July 7 for the previous five years. There were a total of 127 theft events reported in this analysis period, or an average of 25 per year. The average stolen shipment was worth $145,699 per event. Activity for the Independence Day weekend in 2020 was at its highest since 2016 and increased by 123% over the previous year.

In previous years, household goods and food and beverage items were the most commonly targeted commodities. This would include items like appliances, toys, alcoholic beverages and seafood. The COVID-19 pandemic has caused shortages and price inflation of specific goods, and CargoNet believes the items most affected, such as computer electronics, are the items most at-risk this year.

The firm warns specifically that computer electronics coming out of warehouses in California are at particularly high risk, with more than 50 recorded thefts of electronics shipments in the state since September 2020 and 89% more thefts when compared to the year prior. Additionally, CargoNet warns haulers of full truckload theft activity in Ohio, Indiana, Tennessee, North Carolina and Texas due to indications of one or more cargo theft groups operating along major interstates and surveilling warehouses in those states.

California, Texas, Florida, and Illinois recorded the most thefts in this analysis period. Our analysts believe these states are also most at-risk this upcoming holiday, but supply chain professionals should increase security across the Midwest and Southeastern United States in response to recent theft activity.

Mack gets order for seven LR Electric trucks from NYC sanitation dept.

Mack Trucks announced that the New York City Department of Sanitation (DSNY) plans to purchase seven Mack LR Electric refuse models, which will operate in each of the city’s seven boroughs.

New York City's Department of Sanitation has ordered seven Mack LR Electric refuse trucks to go along with the demo model it received last year.

New York City's Department of Sanitation has ordered seven Mack LR Electric refuse trucks to go along with the demo model it received last year.

“The DSNY order for an additional seven Mack LR Electric trucks speaks to the fact that the performance of the current LR Electric demonstrator model collecting in Brooklyn is meeting and even exceeding their expectations,” said Jonathan Randall, Mack Trucks senior vice president of sales and commercial operations. “Mack has long been the number one choice of refuse customers, and we are now well-positioned to be the industry leader in e-mobility as well. The Mack LR Electric is equipped with Mack’s integrated electric powertrain and will help New York City and DSNY achieve its zero-emissions goals.”