The merger application for Canada Pacific (CP) and Kansas City Southern (KCS) rail, green-lit by the Surface Transportation Board (STB) just last week, promises to take 64,000 long-haul truck shipments off the road each year, and the Biden administration will most likely hold them to that.

The merger will create the first single-line railway connecting the U.S., Mexico and Canada, and both STB and CPKC, the name for the merged rail line, explicitly state the goal is taking trucks off the road.

“A combined CPKC will connect North America through a unique rail network able to enhance competition, provide improved reliable rail service, take trucks off public roads and improve rail safety," CP President and Chief Executive Officer Keith Creel said in a press release.

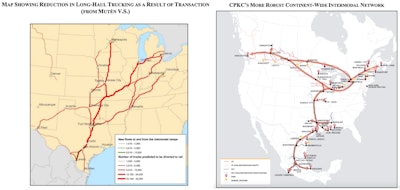

STB "expects the merger and imposed conditions to result in an overall public benefit," with some of those major benefits explicitly spelled out as reduced highway traffic, reduced pollution and moving more shipments to rail systems, which have a better safety record than trucks, according to the board.  Some charts from CPKC's 1,000-plus page merger application showing just how and where the railway plans to take truckloads off the road.CPKC

Some charts from CPKC's 1,000-plus page merger application showing just how and where the railway plans to take truckloads off the road.CPKC

The merger will "give shippers on that railroad the ability to access, without interchange, all three countries – a true NAFTA railroad, or USMCA railroad," said Todd Tranausky, FTR Intelligence's vice president of rail and intermodal on a recent podcast.

"It gives shippers new markets and easier lengths of haul and movements between Canada and Mexico," he continued. "Particularly for grain shippers, for some auto parts shippers, potentially for intermodal as well," the merger could significantly heat up competition.

Car haulers, auto parts haulers, and even dry van operations, therefore, are squarely in CPKC's crosshairs.

This, of course, comes at a time of weakening freight rates in trucking, and something of a "bloodbath" among smaller carriers, where truckers have seen five straight months of freefall, something that hasn't happened since the 2007-2008 financial crisis.

FTR's most recent rates forecast confidently predicts that rates don't have much lower to fall, and that 2023 may well be the year the trucking business gets "back to normal" after a wild ride through the pandemic.

But does losing 64,000 loads a year to rail change that calculus? And can CPKC and the STB's stated goals of reducing truck traffic be taken at face value?

Can trucking take the heat from CPKC?

Essentially, the 64,000 number is a moving target and not necessarily going to make a big dent in trucking, according to FTR vice president Avery Vise. After all, trucks move nearly 11 billion tons of goods each year, and 64,000 truckloads at most would come out to just 2.56 million tons.

"The truck-to-rail diversion certainly was one of the big benefits touted by STB as it fits the Biden administration's pro-environment stance," Vise said. "In practice, what ends up happening will come down to implementation. How reliable will the service be? How attractively priced will it be? Moreover, how competitive will intermodal be versus trucking? Currently, intermodal in general faces a hurdle because trucking capacity is relatively loose, rates are depressed and diesel prices are falling. Those conditions will not be permanent, of course. Therefore, one way to think of this is not so much whether the merger will affect rates and traffic today, but whether it might keep rates and volumes from rising as much in the future when market conditions are stronger."

Vise added that the rail merger may have other knock-on effects, like incentivizing near-shoring, which would keep more manufacturing on the continent, potentially boosting trucking.

On the question of whether or not the merger, or the STB, can actually be expected to reduce truck traffic, Tranausky said to count on a sincere effort on that front.

CP has been "very adamant" about its goal to divert truckloads to rail, and the STB has insisted on conditions that allow it to monitor and ensure those truckload diversions actually happen, he said. "The board is going to be counting to make sure that CP pulls through on" the promised truck diversions, and has given itself seven years (more than the usual five) to read over CP's shoulder, according to Tranausky.

"The board does have very clear statutory authority to oversee the carrier for any representations the carrier made during its filing," he continued on the podcast.

So while CP will be on the line to demonstrate those 64,000 truckloads are hitting the rail instead, Tranausky stressed that neither the government nor CP can actually force any shipper to pick them, and besides playing with price and service the levers to move the needle don't really exist.

Furthermore, 64,000 truckload shipments could move to rail while other factors actually boost truckload shipments by a greater number. STB and CP can't ensure there will be 64,000 fewer truckloads on the road next year, only that they'll take 64,000 truckloads worth of freight.

"It will be very interesting to see how the board views [defining truck conversions] as we go through the oversight period and how the board is able to quantify those conversions, particularly if the overall pie increases over that time," Tranausky said.

That said, CP is very clearly coming for trucking. CP's first new service planned across the border? Perishables from Mexico.

"Perishables have been a truck freight market for 40, 50, 60 years," said Tranausky. CP is going "right at" trucking, "taking it head on," he said. "Sharpen your pencils, get ready to compete."