Although growth in the freight market remains elusive, there also hasn’t been a fallout yet, according to industry analysts at FTR Transportation Intelligence.

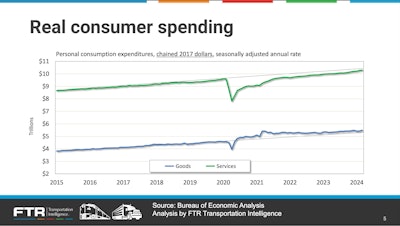

Looking at the current state of economy in the U.S., contrary to what it may seem, consumers are still spending, explained Eric Starks, CEO and chairman of FTR, during FTR’s State of Freight webinar on Thursday.

FTR

FTR

“If we look at what’s been happening with goods, it has been fairly flat. It’s moved a little bit higher, but coming out of the pandemic, it kind of hit that peak, and then, it just stayed there,” said Starks.

FTR’s findings also showed that consumers are spending “just right or at slightly below” pre-pandemic levels. Compared to debt levels pre-pandemic, there’s quite a big difference.

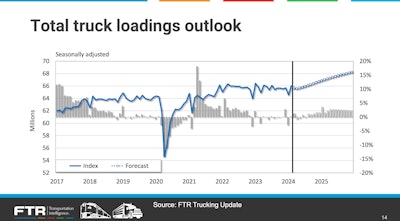

Looking at truck loadings outlook, Avery Vise, FTR's vice president of trucking, noted that it was essentially a flat year. “This year is going to be pretty close to flat as well, but we are going to start seeing later this year, a little bit of improvement, and start to see year-over-year growth, starting in Q3.”

“The period of time where we’re sluggish is starting to transition,” said Vise. Though specialized segments, like flatbed and bulk dump, appear to be in decline, he noted growth could come this year in the dry van and refrigerated tank.

"We do see a stronger market this year. The key takeaway really in all of this is, though, is that while we’re not seeing growth, we also have not seen a big fall off," he said.

FTR

FTR

“As we saw both the stabilization in freight demand and incrementally more active capacity for larger carriers, followed by skyrocketing diesel prices, we did see that dynamic start to change in early 2022,” Vise said. In early 2022, the number of carriers started to come down, while the number of carriers failing started to rise. By late 2022, there had been a consistent decline on a net basis.

"We’ve had some volatility in this trend, especially recently," Vise added, "but, in general, more carriers are failing than are entering the market.”

Truck utilization, which was near 100% in 2022, has fallen to the mid- to high-80%.

Vise noted rates generally begin steadily rising year-over-year by Q3. "The forecast for this year is that spot rates, overall, will be up about a percent," he said. Rates for dry van and refrigerated will be up a little bit stronger than that.

“Although rates do look to start improving in absolute terms by the end of the year, we are forecasting that for all of 2024, they will be down about 2%.”

Vise said that a dynamic that could yield a stronger recovery than FTR’s forecast would be the Commercial Vehicle Safety Alliance’s international roadcheck next week on May 14-16. “That event always results in spike in spot rates,” he noted.