The spot market remains weak, with loads and rates both down year over year, said Avery Vise, vice president of trucking at FTR.

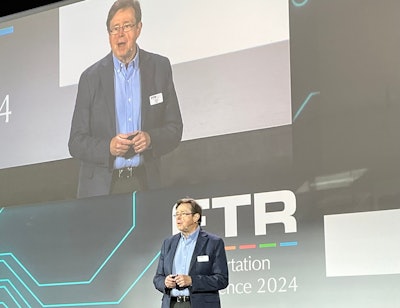

“The spot market is arguably doing as well as last year, arguably floating around the bottom, but there’s certainly no real strength of any kind,” Vise said, speaking at the FTR Transportation Conference in Indianapolis.

Lower diesel prices have offered some relief, but Vise said they don’t expect them to come down much further.

Looking at the broader total freight volume, FTR indicated that there hasn’t been meaningful growth in 2023. “We are not looking at any significant growth this year,” Vise said, with only a slight 1.3% rise next year. “We’re not really forecasting a big [change] on the volume side.”

FTR anticipates truckload spot rates to increase 6.5% to 7% in 2025, following a rise of around 1% in 2024.

On the other hand, Vise said that contract rates have found the bottom of the market, though it is not showing in the data. Truckload contract rates look to be down about 3.5% in 2024, then rise 3% in 2025. Less-than-truckload rates are projected to rise 1.6% in 2024 with forecasted 2% increase in 2025.

FTR

FTR

Total truck loadings have been stable recently, with FTR anticipating a rise of 0.2% overall in 2024. However, Vise said it is expected to rise in 2025. FTR is forecasting that dry van loadings will rise to 1.5% in 2025, while refrigerated loadings is estimated to increase 2.6% in 2025.

Vise said that for-hire fleets have seen active utilization rise to 92%, which is only slightly below the 10-year average.

Though capacity has gradually exited the industry, Vise said that the exit rate has slowed, with a net carrier growth in August. Vise noted how capacity exits would have to be supplemented with a freight volume increase to improve rates.

“I think history has shown that you can’t really get stronger rates just by taking capacity out of estimate. We’re not coming at this with the assumption that if we can just get more capacity out of the market, we would have a big upturn.”

Fleets strategize with internal optimizations

Looking at the continued stagnant market conditions, fleet executives said during a panel at the conference that they don’t expect serious change in the market but are focusing on making the best out of the situation. Doug Jordan, vice president of Jordan Carriers, said they’re focused on efficiency and investing to keep operations safe, looking into accidents, downtime and maintenance for opportunities to improve.

Avery Vise, vice president of trucking at FTR, Doug Jordan, vice president of Jordan Carriers, Lawrence Massengil, chief sales and marketing officer, Big M Transportation, and Rob Sauer, CFO at Hills Bros. Transportation.Pamella De Leon/CCJ

Avery Vise, vice president of trucking at FTR, Doug Jordan, vice president of Jordan Carriers, Lawrence Massengil, chief sales and marketing officer, Big M Transportation, and Rob Sauer, CFO at Hills Bros. Transportation.Pamella De Leon/CCJ

Lawrence Massengil, chief sales and marketing officer at Big M Transportation, said they’re gearing up for when the market flips and focusing on right-sizing the company and financing technology improvements, including investing in key personnel in tech-focused roles.

“It’s been a battle but in a lot of good ways,” said Rob Sauer, CFO at Hills Bros. Transportation. He said it’s important to maintain a mindset that acknowledges the market’s fluctuations yet recognizes the significance of continuing to invest and spending strategically. The company reduced overhead costs by 10% and focused on AI investments to offer customers more visibility into their freight.

[RELATED: Survey: Companies plan to increase use of AI over the next 2 years]

Talking about rates, Massengil said they focused on customer relationships and having “open, honest conversations with what rates we need to be profitable.”

“As rates come down with our customers, there are some other revenue streams that we’ve been able to focus on,” Sauer said, noting how providing other services such as equipment maintenance makes it easier for some customers to come to an agreement about rates.

For-hire carriers are also facing the trend of private fleets expanding their capacity and handling more of their own freight internally. In recent months, private fleets have been acquiring Class 8 trucks at a substantial rate compared to for-hire carriers.

"The impact is significant, especially at a time when we’re all struggling to find good freight," Sauer said. “It’s a small part of the market, but when it hits your company, it can be significant. It’s usually on a pretty good lane. They don’t usually take the lanes that aren’t high frequency.”

While a hybrid competitive market is present, Massengil emphasized they have made customer relationships a priority by doing intentional business reviews to get ahead of service issues.

Driver recruitment and turnover is still a huge cost, the executives said. Massengil said they saw drivers leaving based on three major factors: pay, home time and disputes within the company. To improve company relationships, the company raised the number of fleet managers per driver to offer more support and launched a podcast to promote company transparency and improve relationships with upper management.

A few years ago, Sauer said said Hills Bros. launched its own driving school, but in the past three to six months, the quality of drivers has been declining. “We think a lot of those are more experienced drivers that are trying to come back.”

Meanwhile, Jordan Carriers improved its orientation and mentorship program to increase emphasis on safety and driver retention, resulting in lowered accidents and claims costs.