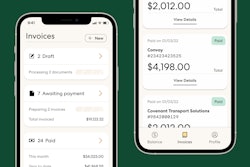

Freight factoring has become a significant financial tool for businesses, yet opinions on its efficacy vary widely. Known as accounts receivable (A/R) financing, factoring involves trading invoices for immediate cash at a slight discount. This enables companies to meet monthly expenses promptly, including payroll, without resorting to costly bank loans or high-interest credit cards.

Trucking companies, in particular, benefit from factoring as it provides crucial cash flow for ongoing operations. With payment delays often spanning up to 90 days after load delivery, factoring helps cover essential expenses like payroll, insurance, and maintenance. An added advantage is that the factor, typically a bank, assumes the responsibility of collecting on the invoice, allowing carriers to focus on their next load.

Freight factoring serves as a powerful tool for businesses, offering opportunities for growth and improved cash flow. Here are key tips to enhance your factoring experience and streamline operations:

Form an effective partnership with your factor

To ensure the smoothest factoring experience, businesses should establish a partnership with a factor that understands their unique requirements and offers valuable insights and best practices. Thoroughly vetting potential factoring lenders is essential, seeking referrals and feedback from industry peers. Opt for factors with specific expertise in the transportation industry, as they possess a deeper understanding of your business needs and can aid in long-term growth.

Evaluate the factor

Carefully reviewing and understanding the contract terms before signing is crucial to ensure fairness for both parties. Be cautious of excessive due diligence deposits, which are commonly required but should be reasonable and appropriate for the company's size and scale. Conduct due diligence on potential factoring partners, verifying their credibility through web searches, professional business websites, and legitimate contact information.

Confirm your designation as the carrier

To avoid potential issues, it is crucial to ensure your company is listed as the carrier on rate confirmations, guarding against the practice of double brokering. Additionally, be vigilant for red flags during the factoring process, such as excessive delays in account setup or uncomfortable or nonsensical questions during underwriting.

Value-added services that set you apart

Apart from invoice factoring, partnering with a company that offers additional services can be advantageous. These may include credit checks for brokers, equipment financing, treasury services, and various banking solutions tailored to your evolving business needs.

Discuss your cash flow needs with your factor

Instead of turning to higher-interest unsecured loans for additional cash flow, communicate with your factoring partner about your financial challenges. They may provide more favorable term loans or lines of credit with lower interest rates and better repayment plans, ensuring smoother financial management for your trucking business.

By following these essential tactics, businesses can maximize the benefits of factoring, secure consistent cash flow, and foster long-term success in the trucking industry.