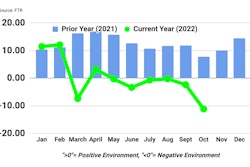

Contract rates have spent the second half of 2022 on a slide, following a downward trendline that spot rates have seen for almost the entire calendar year.

Both spot and contract rates are likely to ring in the New Year on the same slope, with the spread between the two narrowing.

Average spot and contract van rates were virtually equal in February, but the gap between spot and contract van rates reached an all-time high in November: 69 cents, according to DAT. It started to close in December.

“November contract replacement rates — the difference in the rate when one contract ends and another begins — were 12% and 16% lower for vans and reefers, respectively, compared to October,” said Ken Adamo, DAT Chief of Analytics. “We expect spot and contract pricing to continue a downward trajectory, but for the gap to narrow during the first quarter of 2023.”

A year ago, contract replacement rates for van freight were 10%, 12%, and in some cases 20% higher than the rate they replaced. Today, the average replacement rate is closer to minus-15%, meaning the new rate is 15% lower.

“Shippers are exerting themselves and negotiating lower contract rates now, in many cases in exchange for giving carriers more loads and better lane density," Adamo said. "It takes time for those RFPs to be awarded and for new contract rates and lanes to be loaded into the TMS and start showing up on carrier invoices. When they do, contract rates will be lower, and the gap between spot and contract pricing will start to narrow. The next freight cycle will begin, with more freight coming to the spot market where rates are far more reactive.”

The national average shipper-to-broker contract van rate fell 2 cents in November to $3.07 a mile, 12 cents higher than the contract rate in November 2021, according to DAT. The average contract reefer rate was $3.37 a mile, down 1 cent, and 27 cents higher year over year. The average flatbed rate increased by 3 cents to $3.65 a mile, 31 cents higher year over year.

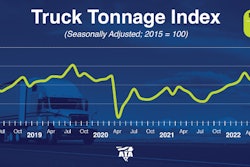

A report compiled by Arrive Logistics forecasts an overall freight tonnage decline as economic conditions return to pre-pandemic levels, pushing the spread between contract and spot market rates even closer.

"Market conditions in at least the first half of the year will look much like they did in 2019," said David Spencer, director of business intelligence at Arrive Logistics. "We learned then that a gap of 20% or more can persist for an extended period as contract rates ease slowly. We anticipate a similar trend in 2023, with spot rates likely bottoming out in Q1 or Q2, and contract rates experiencing downward pressure through the year's first half."

One factor that could accelerate this process, Spencer said, is that many more shippers today are using technology to reprice at will and test the spot market when a carrier rejects a load or lane volume is too low to warrant contracting. However, it is too early to tell if that theory will play out.

Still, truckload demand remains healthy compared to historical norms, though improved routing guide compliance has caused significant spot market demand declines. On the consumer front, inflation is leading to a decrease in spending, and rising interest rates are slowing the housing boom, which means fewer goods purchases and, in turn, decreased demand. That said, backlog fulfillment in manufacturing and industrial production will likely help prevent demand from falling off a cliff, supporting an outlook for more gradual easing, according to Arrive's report.