According to a Bloomberg and Truckstop.com survey of owner-operators and small fleets, carriers who have struggled with sluggish demand and low rates are now noticing signs of potential improvement, although some are still contemplating a career change.

While there is increased optimism over the outlook, Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence, said more carriers indicated plans to exit the industry compared to prior survey. A faster pace of carrier exits could hasten the market’s return to equilibrium and provide a better backdrop for rates next year.

Uncertainty still clouds carriers’ futures, according to the survey. More carriers are considering leaving the industry, with 15% expecting to exit within six months, up 6 points from Q2. The slow pace of capacity reduction continues to weigh on the market. However, a faster exit of excess capacity could support a rise in spot rates, potentially paving the way for a better environment in 2025.

“Carriers are optimistic that the toughest times are now behind them,” said Kendra Tucker, CEO of Truckstop.

Truckstop’s survey noted rates may rebound soon. Spot rates remained under pressure in the third quarter, averaging a 17% drop excluding fuel, according to respondents. However, optimism is growing – 29% of carriers expect rates to rise in the next 3-6 months, which is 6% higher from three months ago.

Carriers eyeing rate increases

Old Dominion Freight Line (CCJ Top 250, No. 9) last week announced a general rate increase of 4.9% effective in December. Todd Polen, vice president of pricing services, said that it is intended to partially offset the rising costs of real estate, new equipment, technology investments, and competitive employee wage and benefit packages.

In third quarter earnings, publicly traded carriers such as Werner (No. 13) also noted signs of improvement as well. Derek Leathers, CEO of Werner, noted in an analysts call, “It is our expectation as we look into 2025 that the time for rates to be going up is upon us. The question is the magnitude, and I think it’s too early to tell.”

Knight-Swift Transportation (No. 4) CEO Adam Miller said he believes rates could, during the later part of the bid season, up high single digits perhaps. "There's still a long ways to go on margin recapture to make the public companies closer to where they've been historically and ourselves included in that," he added. "So we've got a ways to go, and we plan to get there with rate, probably productivity, and continue to focus on our cost structure to put us in a better position to again improve margins but also bring value to our customers.”

Covenant Logistics (No. 36) also raised rates a number of times last quarter and anticipates doing so again next year, CEO David Parker said in an earnings call. In the second quarter, the motor carrier rolled out three rate increases in 45 days and increased prices another three or four times in Q3, Parker said. The carrier will propose a 2-4% increase in the current bid season and another 2-3% increase in the second half of next year, he said. “I think we’ve got relationships enough with our customers that we can be successful in getting some,” he noted.

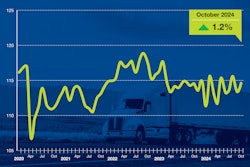

Signs of a market nearing equilibrium are emerging. Truckstop’s Market Demand Index for the North American trucking rose by 13% on average in Q3 compared to last year, marking the third straight quarter of year-over-year improvement.

The report indicated that demand may gradually recover. Although carriers reported lower volume in Q3 – with 56% noting weaker demand compared to last year – the outlook sentiment appears more optimistic. Forty percent of respondents expect higher volume in the next 3-6 months, a 7% increase from Q2. The report noted the improved outlook may also drive more equipment purchases, with 24% planning to buy in the next 3-6 months. Still, weak demand remains deterrent for 34% of respondents considering equipment purchases.