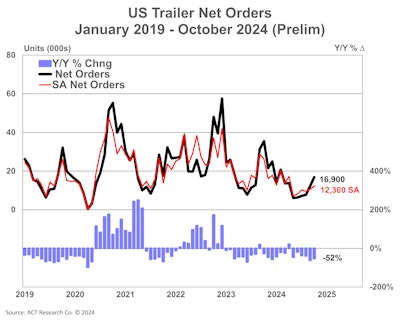

Preliminary net trailer orders had an upturn of about 4,800 units from September to October, according to ACT Research. Though at 16,900 units, it was down 52% year-over-year, compared to last October.

ACT Research

ACT Research

FTR Transportation Intelligence reported that trailer net orders in October climbed 34% month-over-month to 15,970 units, reflecting expected seasonal trends, but were down 55% year-over-year. The October figures had been the lowest net trailer order since FTR began tracking data in 2013. Despite the opening of 2025 order boards, FTR noted that net orders remain sluggish, falling short of expectations and showing little momentum.

Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research, said that since it’s still the early stage of the traditional start of the order season, the month’s uptick was expected. However, it’s no surprise that the figures remain significantly below October 2023 levels, reflecting the soft demand seen throughout the year.

Similar to a month ago, FTR pointed out that U.S. trailer demand continues to face headwinds from a challenging truck freight market. Year-to-date trailer net orders have dropped 36% year-over-year to 108,898 units per month. While total trailer production increased 8% month-over-month in October to 16,603 units, consistent with seasonal patterns, it was down 38% year-over-year. This production level is 34% below the five-year average for October and represents the second-lowest monthly output since August 2020.

McNealy noted, “October’s data brings year-to-date 2024 U.S. trailer orders to 118,300 units, a 37.5% contraction when compared to the first 10 months of 2023."

She warned that despite the month-over-month improvement, October's numbers continue to reflect the anticipated downturn in trailer demand. Ongoing weak fundamentals, low valuations for used equipment, and already well-stocked dealer inventories are factors limiting stronger activity, especially into early 2025.

“An order uptick showcasing demand, or the lack thereof, depends not just on the first two months of the new order cycle, but at least on order volumes through January 2025,” McNealy added.

FTR’s data indicated that in October net orders were slightly below total production, reducing backlogs by 1,017 units to 82,089 units. The combination of higher month-over-month production and smaller backlogs pushed the backlog-to-build ratio down to 4.9 months, its lowest since June 2020 and about a month below pre-2020 average. The results highlight the growing pressure on OEMs to adjust production downward in the near term, FTR noted.

Dan Moyer, senior analyst, commercial vehicles at FTR, commented, “With the launch of the 2025 order season, North American Class 8 net orders increased 6% year-over-year in September-October 2024, while U.S. trailer net orders dropped by 58% year-over-year during the same period.”

Moyer stated that the sharp decline in trailer demand can largely be attributed to fleets prioritizing investments in new power units over trailers, influenced by reduced profitability or shifts in trade cycles. Some fleets may also be delaying trailer orders in anticipation of post-election market stability or potential price reductions.

“Slightly elevated trailer inventories, reduced fleet spending, and shrinking backlogs are expected to pressure trailer production levels through the rest of 2024. If 2025 trailer orders fail to rebound soon, some OEMs may need to extend or deepen production cuts into next year,” Moyer added.

McNealy also pointed out industry concerns about declining optimism, based on lower backlogs than ACT Research has seen in a decade. Though the economy seems to be showing signs of positive momentum, McNealy noted that weak carrier profitability continues to weigh on trailer orders as 2025 approaches.