Total U.S. trailer net orders in February declined 18% from the previous month but increased 3% compared to the same period last year, reaching 20,874 units, according to FTR Transportation Intelligence.

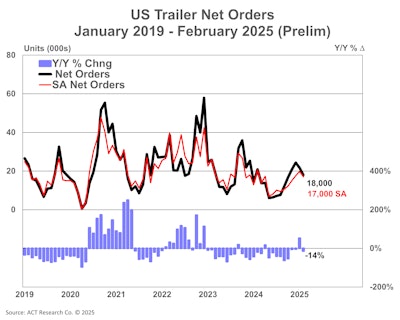

This marked the fourth straight month in which net orders surpassed 20,000 units with positive year-over-year growth. However, a slow start to the 2025 order season (September 2024 through February 2025) has kept cumulative net orders 14% lower year-over-year at 124,737 units.

ACT Research also reported that preliminary net trailer orders showed a 17% decline from the previous month, as orders fell by approximately 3,700 units, reaching around 18,000 units. This represents a 14% drop from February 2024.

Jennifer McNealy, director of CV market research at ACT Research, noted that the decline was anticipated, as it aligned with typical seasonal slowdown in trailer orders.

FTR noted that while many fleets prioritized buying power units over trailers in 2024, U.S. trailer net orders for 2025 have so far reached 46,298 units — outpacing U.S. Class 8 net orders by 9,554 units.

“Whether this trend will continue in the near term is uncertain,” FTR said.

McNealy also cautioned that while trailer orders continue to be placed, they are expected to be subdued throughout 2025 due to a struggling for-hire trucking market, low used equipment valuations, relatively high dealer inventories, and high interest rates, which are dampening purchasing activity.

FTR’s data showed that trailer production in February had a 23% surge from the previous month to 15,800 units but remained 34% below last year’s levels. The above-seasonal monthly increase likely stemmed from improved order activity in recent months and efforts by OEMs to produce additional units ahead of potential tariffs expected in March or April.

[RELATED: Tariff plans could disrupt truck production and pre-buying activity]

Year-to-date trailer production for 2025 remains 34% lower than last year. As net orders exceeded production, backlogs grew by 4,298 units (a 4% increase month-over-month). The faster rise in production compared to the backlogs decreased the backlog-to-production ratio to a healthy 7.8 months.

“New and pending U.S. tariffs, along with retaliatory measures, pose significant risks to the North American trailer market,” said Dan Moyer, senior analyst, commercial vehicles, at FTR.

Tariffs won’t just impact imported trailers, Moyer pointed out. They could also affect domestic trailers depending on the extent of imported materials, and the effects could be broad. It could lead to higher production costs, squeezed margins for OEMs, and potential slowdowns in demand, he said.

Fleets could also see increased trailer prices and longer lead times, possibly shifting investment back toward power units.

Moyer also noted another key factor to watch: the Environmental Protection Agency’s announced plan to revisit its 2027 truck NOx emissions regulations.

“(This) change disrupts fleet equipment strategies that otherwise presumably would have led to fleets prioritizing power unit orders over trailers by late this year, if not earlier,” he said.