RoadSync has established itself in the transportation industry as a mobile payment platform used by road service providers.

RoadSync has established itself in the transportation industry as a mobile payment platform used by road service providers.Fuel transactions may be as easy as swiping a card or automatically identifying a truck and activating a pump using RFID signals. Other kinds of over-the-road transactions continue to require phone calls, paperwork and trips to the bank to deposit checks to complete.

Approving and paying for mobile repairs and towing services, freight handling (lumpers), late fees and other accessorial charges for loads are a few examples.

In 2016, Robin Gregg left FleetCor to become chief executive of RoadSync, a startup that was in the process of developing a mobile payment system for the transportation industry. The company launched the platform in 2017.

Gregg has more than 15 years of experience working for electronic payment providers, including seven years with FleetCor, which acquired Comdata in 2014.

“I was definitely drawn to doing more in this space. There are lots of problems to be solved,” she says. “I am excited about what can be done. We want to help businesses reduce paper and phone calls.”

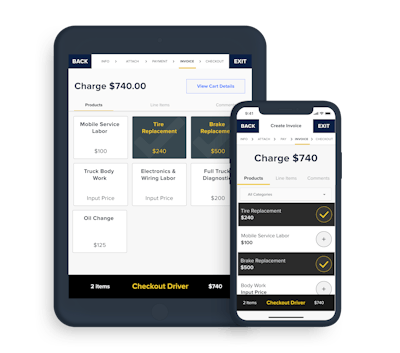

She describes RoadSync as a cloud-based point-of-sale platform that has invoice generation and workflow tools designed for people and businesses to request and accept payments digitally. Think of it as a version of Square that was built specifically for handling payments in the transportation industry.

“We figured out how to create an experience that works for logistics and transportation by using industry-specific forms and workflows,” she explains.

Gregg says the company is off to a fast start by helping people and businesses collect payments from owner operators and company drivers for common over-the-road services and expenses. For example, warehouses use RoadSync to collect accessorial fees for loading and unloading trailers. It also counts truck repairing and towing companies among its customers.

“Companies that do repairs and tow merchants are able to send out digital work authorizations to the company with clarity about what is going to be charged,” she says.

The driver can pay for a transaction using any debit, credit card or fleet check on the spot. The platform also allows the merchant to text or email the invoice to a motor carrier for real-time payment.

RoadSync is not currently being used by carriers and owner-operators to receive freight payments from shippers and brokers, but that is a future possibility, she says.

“We are interested in servicing anyone that does not have a tool to invoice and collect payments,” she says.

Funds received through the app for payment are deposited directly into the bank account that the user chooses. RoadSync plans to release a new feature for smaller customers that will enable them to have funds transferred directly to a debit card, she says.