The Inflation Reduction Act of 2022 will reduce our country’s carbon emissions by roughly 40% by 2030 and minimize shocks caused by volatile fuel prices by providing significant incentives for companies to invest in clean assets with predictable operating costs.

The bill will provide more than $400 billion to improve energy security and fight climate change. Most importantly, it provides incentives for individuals and corporate entities to accelerate a transition toward cleaner energy sources.

[Related: Inflation Reduction Act likely to influence trucking more than inflation]

The bill is complex, but tax credits can be leveraged by trucking companies to improve the ROI of fleet upgrades, expansions and conversions to clean fuel, and can result in significant savings for 3PLs, manufacturers consumer-facing brands, retailers and everyday Americans.

The details of the tax credit are found in Section 13403 (Commercial Clean Vehicles) of HR 5376, but the tax credit that your company can take advantage of is based on several factors, and is the lesser of the credit when computed in a few ways:

The type of fuel used by the vehicle (up to a 30% credit)

The cost of a comparable diesel or gasoline powered vehicle (up to the price difference)

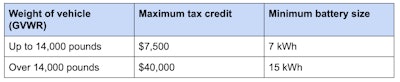

The GVWR (Gross Vehicle Weight Rating) of the vehicle (up to a $40,000 credit)

The vehicle has to meet or exceed a battery size threshold as well.

The type of fuel

The first way to compute the credit is based on the fuel used by the vehicle.

Electric and Hydrogen powered trucks and vans (or other technologies that don’t rely on internal combustion) are eligible for up to 30% of the purchase price. Hybrid trucks and vans – those which have gasoline or diesel engines in addition to using battery or hydrogen – are eligible for a tax credit of up to 15% of the purchase price. Hybrid vehicles must also be plug-in capable and can’t rely solely on the combustion engine to charge the battery.

For example, if you purchase an Electric Class-8 semi with a 500 kWh battery for $150,000, this number would be $45,000 (but note the credit is capped at $40,000 which we’ll discuss below)

The cost of a comparable vehicle

Next, you would compare the cost of the vehicle to a comparable vehicle, which the bill defines as “any vehicle which is powered solely by a gasoline or diesel internal combustion engine and which is comparable in size and use to such vehicle”. If a comparable vehicle to the semi you purchased for $150,000 was available for $112,600, this number would be $37,400.

The GVWR and Battery Size

Larger trucks and vans require bigger engines and more raw materials to produce, so the credit scales with the size of the truck. Vehicles have minimum battery size requirements associated with them, which will primarily apply to hybrids to ensure a sufficient amount of the driven mileage is spent under non-combustion power.

So if you purchased that $150,000 Class 8 semi with a 500 kWh battery, you would meet the battery test, and your credit would be the lesser of the 30% credit for being electric: $45,000; the comparable vehicle test: $37,400; or the maximum credit: $40,000

The smallest value here is $37,400, so the cost of your $150,000 truck with credits would net to $112,600 – the same price as the comparable diesel powered vehicle.

ROI makes this an obvious choice

Tax Credits for clean commercial vehicles align with the core principles of The Inflation Reduction Act. Clean fuels tend to have much lower price variability (and in the case of both electricity generated by renewables as well as green and blue hydrogen, are seeing reductions in price in many markets), helping stem inflation and provide predictability to operators.

Replacing an existing diesel truck with an electric or hydrogen choice can pay off quickly. Without the tax credit, a typical operator might see a positive ROI within 5 years and achieve an IRR of 5-10%. With the tax credit, payback under the same operating scenario would occur within 3 years and achieve an IRR of 20-30%. Investing in your own fleet could be superior to many other options, and could even be an attractive way to leverage debt financing.