The trucking industry is faced with many regulations. When it comes to emissions, the vehicle and powertrain have been regulated for decades. This regulation has certainly cleaned the air and been positive for the environment.

As I think about my career over the last 40 years, I am proud of how we as an industry have made monumental improvements and reductions in emissions. Not only has this cleaned up the air, but it also has created employment for many of us as we have been in a cycle of launching new products every three years to meet new emissions standards. It also has made the trucking industry exciting from so many aspects: engineering, business challenges, marketing, etc.

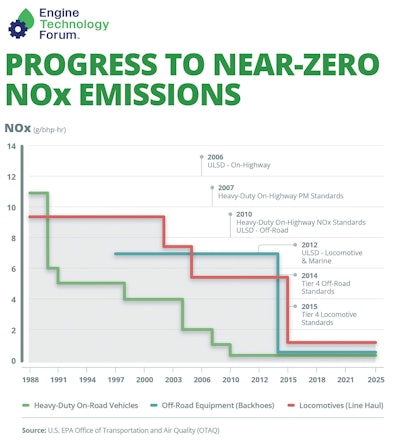

The fruits of our labor are illustrated in the figure below. This shows a 98% reduction in NOx since 1988 for on-road vehicles. As we look toward the upcoming EPA 2027 Low NOx rule, we can declare a 99% emissions reduction.

At the same time, these regulations are costly for fleets, OEMs, and Tier I suppliers. When thinking about all the different configurations of vehicles in the Class 4 to Class 8 space, there is enormous complexity. It is a challenge to simultaneously launch new products that meet ever-changing emission requirements. This is another example of the complexity of the Messy Middle, and all resources are stretched: cash, people, test cells, etc.

There are several regulations that have recently gone into effect (e.g. state Advanced Clean Fleet, Omnibus, and ACT) or will go into effect over the next few years. While there have been regulations prior to these, the industry now is focusing on the following regulations: the federal EPA27 Low NOx, EPA Greenhouse Gas Phase 3, CARB ACT, and CARB ACF. These are just a few of the regulations we are facing, and there are others such as California’s Warehouse Actions and Investments to Reduce Emissions (WAIRE) warehouse rules and electric transportation refrigeration unit (eTRU) rules that are being enacted.

EPA and CARB provide some flexibility in the rules to allow the OEMs to manage these changes. More specifically, there is a term called Average, Banking, and Trading (ABT). This allows the OEMs to meet the regulations at a fleet level (or possibly by vehicle group level).

The OEM can build credits if their product has lower emissions than the regulated thresholds. This allows them to release some products at higher levels and therefore gives the OEM some flexibility to manage their product launches. OEMs also can build deficits within a given timeframe. And interestingly, OEMs can sell credits to each other.

Tesla is an interesting case study in the automotive industry. Selling emission credits has been a significant source of revenue for the company. A New York Times article indicated that Tesla has earned billions of dollars over the years. In the first nine months of this year, $2.1B of revenue and 43% of their net profit has come from the sale of automotive credits to car manufacturers that had credit deficits because of their build mix choices.

In the commercial vehicle market, CARB allows for the transfer and sale of Zero Emission Vehicle (ZEV) credits for vehicles sold in California. CARB does not track the monetary value of the sale, but it does require both parties to submit documentation acknowledging the trade of credits. To date, there has not been a lot of ZEV transfers and sales yet, but we are still early with ZEV mandate regulation. One industry expert I spoke with felt this option would not be exercised because it gives revenue to a company’s competitors. But we are still early in navigating these mandates.

If we step back and think in general about NOx and GHG credits, the regulators allow banking, trading and selling for these reasons:

ABT encourages the early adoption of new technology

This is good for the environment, and I like to think of it the way I do the time value of money. If someone gives you $1000 today, it has more purchasing power than it will five years from now. Introducing low emission vehicles early has the same effect. It is better to run that vehicle now vs waiting five years from now. Environmental benefits can be gained now vs five years from now.

ABT provides flexibility to the manufacturer, allowing them to navigate through the Messy Middle easier

An OEM can launch some vehicles at or below the certified limits, generating credits and then delay some of the other vehicles. As we think of all the complexity of different truck models, different powertrain configurations, different axles, etc., it allows the OEM to manage their precious limited resources: cash, people, test cells, etc. ABT prevents major market disruption by allowing the OEM to introduce some emission changes over a few years.

Key differences

While there are similarities, the ABT rules for each type of regulation are different (NOx, GHG) and the regulating bodies (EPA and CARB) manage this differently.

NOx EPA credits

An OEM or engine producer can build NOx credits. This is why we have seen some engines certified lower than the current NOx standard. The manufacturer is essentially “banking” credits on that engine model. The amount of the credit is defined by EPA with an equation. A simplified explanation is that it is a function of the amount the certified engine is below the required NOx limit, production volume, and the useful life. As we think about the upcoming EPA27 NOx requirements, this implies that a manufacturer could generate partial credits by being lower than the required NOx limit but not meet the new emission warranty expectations.

GHG or CO2 EPA credits

It is important to note that the GHG regulation is primarily at the vehicle level, but the engine does have some requirements placed on it. The vehicle manufacturer has many “knobs” to meet the CO2 requirements. Examples are aerodynamics, tires, and powertrain. The powertrain consists of the engine, aftertreatment, transmission, and axle. Hybrids potentially also could be used to meet the emissions standards. GHG Phases 1 through 3 do place some CO2 limits on the engine. The OEM and engine manufacturer can generate credits (or deficits) of CO2. Banking and trading can take place, the way it does for NOx. One thing that is different between GHG and NOx credits, is EPA makes the GHG credit information visible to the public. This is not the case with NOx credits. The GHG information typically lags the launch of the vehicle by one to two years. Here is an example of what EPA provides regarding the 2022 models.

California ZEV and NZEV credits

As mentioned earlier ZEV credits can be sold from one OEM to another. CARB also allows for “NZEV” credits. These are near zero emission vehicles which would consist of an internal combustion engine and a hybrid. The NZEV must meet certain criteria as to the number of miles that the vehicle can run on the battery. The NZEVs come at a discount. Also, the NZEV and ZEV credits are classified by vehicle group. The larger the vehicle, the higher the factor. These credits, like others, do expire.

When NACFE coined the phrase “Messy Middle,” no one imagined how powerfully descriptive it would be. We normally think of the Messy Middle in terms of complexity and variations of different powertrain configurations.

ABT also should be considered in the Messy Middle, both as a tool that the OEMs can use but also as something that has tremendous complexity. Even though it is complex, it is a great tool that will promote new technology, early adoption of low emission vehicles, and something that allows the OEMs to manage their precious resources.