Guillermo Garcia said the biggest mistake he made when he started his over-the-road trucking business in the U.S. was following the crowd on rate per mile (RPM) when it came to booking loads. He said everyone in the industry is obsessed with RPM, but that’s not always the best route when you’re a small business.

Garcia has since co-founded and leads advanced freight booking and fleet management platform SmartHop, which created the MPI (market profitability index) using its own data and information from customers’ operations to give them real-time profitable load recommendations.

The company is now using that information to create monthly profitability reports focused on small fleets to provide insight into cities where it’s easiest to pick up a profitable load from the spot market, as well as a breakdown of the previous month’s lanes by profitability. It analyzes millions of reefer and dry van spot market loads from 70 U.S. markets to highlight the most profitable markets so carriers can make smarter booking decisions to drive profit for their business.

The freight market is challenging right now, and Garcia said it is best to diversify freight sources – utilizing a mixture of contract lanes, direct broker relationships, and filling any remaining capacity needs with the spot market – in these conditions.

“Based on the data, what I suggest is for people to look at their businesses in terms of profits, not RPM, and really stay in the lanes, the areas or the regions that, based on the information, are performing best because every additional dollar that you can get in a market in a situation like this will be important for the success and the sustainability of your business long term,” he said. “Basing your decisions on data will help you make decisions in a more educated way. You better make good decisions; any bad decision can take you out of business.”

The inaugural SmartHop Profitability Report, which highlights July data, found the San Francisco, Los Angeles and Chicago areas – or “Hot Markets” as the report calls it – to be the best for reefer. Chicago was the only hot market for dry van. After Chicago, Terre Haute, Indiana, and Louisville, Kentucky, were the next best markets for dry van loads, but they were under the threshold to be considered a Hot Market.

Hot markets are determined based on SmartHop’s MPI. The score must be 85 or above, meaning that the profitability of that market is much higher than the U.S. average (50 MPI), to be considered a hot market – cities where it’s easiest to pick up a profitable load from the spot market.

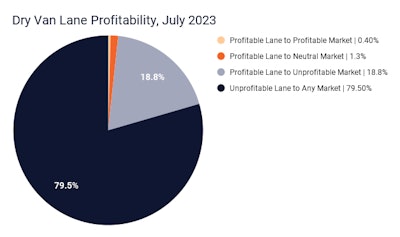

The report also offers an analysis of reefer and van lane profitability based on initial load profitability while factoring in the ease of picking up another profitable load in the destination market. The report found that for both dry vans and reefers, the majority of lanes in July were unprofitable, with 79.5% and 65.5% unprofitable lanes, respectively. The next largest lane category for both vans and reefers was profitable lanes to bad markets, with 18.8% of dry van lanes and 30.6% of reefer lanes falling into that category. To stay on the profitable path, Garcia said carriers should aim to create trips out of profitable lanes ending in profitable and neutral markets, which made up 1.7% of dry van lanes and 3.9% of reefer lanes in July.

Garcia said this report is just a starting point and recommends fleets use it as only part of their strategy for booking loads. While fleets can rely on historical data to plan ahead, it’s only one piece of the puzzle. He said fleets need to leverage past data in addition to current information as well as relationships with technology that provide real-time data.

“We can’t control the market; the market goes down, and the market goes up. What we can do is to help our customers stay on top of the wave,” he said. “When the market rebounds, if you are on top of the wave that will mean that you will be in a much better position profit-wise than the rest of your competitors. And hopefully you're provisioning for that downside again because it's going to come.”