After the strong finish to last year, the construction start statistics have shown “lackluster” activity during the first two months of 2014, and builders continue to express concerns over the weather, skilled labor shortages and the rising cost of materials. While construction employment is up in many areas, the industry still remains worried about the future of federal spending on highway projects.

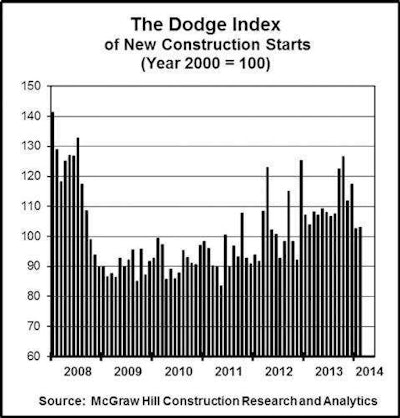

At a seasonally adjusted annual rate of $486.7 billion, new construction starts in February were essentially the same as January’s amount, according to McGraw Hill Construction, a division of McGraw Hill Financial.

The flat pace for total construction starts in February was due to a mixed performance by major sectors: less nonresidential building, but more housing and public works.

For the first two months of 2014, total construction starts on an unadjusted basis were reported at $66.7 billion, down 3 percent from the same period a year ago, according to McGraw Hill.

February’s data kept the Dodge Index at 103 (2000=100), remaining below the full year 2013 average for the Index at 111.

“While construction activity has generally trended upward over the past two years, the monthly pattern has frequently been hesitant, and early 2014 has turned out to be one of those hesitant periods,” says Robert A. Murray, chief economist for McGraw Hill Construction. “To some extent, the harsh winter weather has played a role in dampening construction activity, particularly as it relates to single family housing. At the same time, multifamily housing in early 2014 has been able to strengthen further.”

The Dodge Index of New Construction Starts. (PRNewsFoto/McGraw Hill Construction)

The Dodge Index of New Construction Starts. (PRNewsFoto/McGraw Hill Construction)For nonresidential building, the upturn so far has been much more gradual and subject to setback, such as what took place in this year’s first two months, Murray adds.

“Still, the commercial building sector is seeing rising occupancies and rents, and the improved fiscal health of states and more financing from bond measures should help the institutional building sector stabilize, which would enable nonresidential building to soon regain upward momentum,” he says.

For nonbuilding construction, the prospects for renewed growth in 2014 are more limited, given the comparison to 2013 which included the start of several massive public works projects, in combination with the continued retrenchment for new electric utility starts underway after the record high reached back in 2012, he concludes.

Nationwide housing starts were virtually unchanged in February, inching down 0.2 percent to a seasonally adjusted annual rate of 907,000 units, according to newly released data from the U.S. Department of Housing and Urban Development and U.S. Census Bureau.

“Continuing the January trend and in line with our recent surveys, builders are in a holding pattern. Poor weather is keeping many from getting into the field and they continue to face challenges related to a shortage of lots and labor,” said Kevin Kelly, chairman of the National Association of Home Builders and a home builder and developer from Wilmington, Del.

Single-family housing construction rose 0.3 percent in February to a seasonally adjusted annual rate of 583,000 units while multifamily starts edged 2.5 percent lower to a 312,000-unit pace.

Regionally, combined housing starts activity was mixed in the month, posting gains of 34.5 percent in the Midwest and 7.3 percent in the South and declines of 37.5 percent in the Northeast and 5.5 percent in the West.

Issuance of new building permits rose 7.7 percent to a seasonally adjusted annual rate of 1.02 million units in February. Single-family permits edged down 1.8 percent to 588,000 units and multifamily permits rose 27.6 percent to 407,000 units. Regionally, overall permits rose 6.3 percent in the Northeast, 9.9 percent in the South and 17.9 percent in the West but declined 11.8 percent in the Midwest.

Consequently, builder confidence in the market for newly-built, single-family homes remains weak. While the March NAHB/Wells Fargo Housing Market Index rose one point to 47, the index’s components were mixed: Current sales conditions rose one point to 52 component measuring buyer traffic increased two points to 33. The component gauging sales expectations in the next six months fell one point to 53.

“A number of factors are raising builder concerns over meeting demand for the spring buying season,” says NAHB Chief Economist David Crowe. “These include a shortage of buildable lots and skilled workers, rising materials prices and an extremely low inventory of new homes for sale.”

Any number over 50 indicates that more builders view conditions as good than poor.

The three-month moving averages for regional HMI scores all fell in March. The Northeast dropped three points to 35, the Midwest fell three points to 53, the South posted a four-point decline to 49 and the West registered a two-point drop to 61.

Construction employment, however, expanded in 195 metro areas, declined in 90 and was stagnant in 54 between January 2013 and January 2014, according to a new analysis of federal employment data released today by the Associated General Contractors of America.

Association officials noted, however, that despite the gains construction employment remained below peak levels in all but 21 metro areas.

“It is a sign of the continued strengthening of the construction industry that nearly 60 percent of metros added construction jobs from a year earlier despite the severe winter conditions in much of the country this January,” says Ken Simonson, the association’s chief economist. “Nevertheless, the industry’s recovery has a long way to go with only a smattering of metro areas exceeding their previous peak January level of employment.”

Association officials said the latest figures were a sign that construction employment is rebounding in many parts of the country, but most places still have a long way to go before returning to prior employment levels. They added that many contractors across the country were worried about a possible slowdown in federally-funded transportation projects this summer when the federal Highway Trust Fund is expected to hit a zero balance.

“The industry is slowing digging itself out of a construction employment hole that got pretty deep during the past few years,” said Stephen E. Sandherr, the association’s chief executive officer. “If Congress and the Obama administration can’t figure out a way to address highway funding shortfalls very soon, that hole is only going to get deeper.”