CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

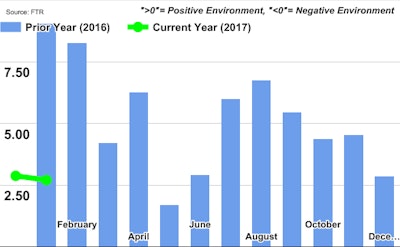

“We expect a productivity and capacity hit to the industry, though the effects will be felt differently, with early adopters ahead of the curve. One of the big issues we expect companies to continue to struggle with is the driver situation, with the number of new hires not keeping pace with overall demand for drivers,” says Starks. “If capacity doesn’t meet demand, then truckers will be able to raise prices. However, we don’t expect to see that impact until late 2017, or into 2018.”

FTR notes it’s also monitoring trade policies from the Trump Administration, which could “have immediate and detrimental impacts on freight transportation,” says Starks, should Trump policies spark a trade war.

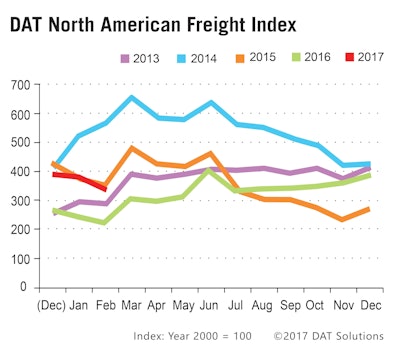

Van and reefer rates dipped in February, while flatbed rates climbed. DAT notes, however, that load-to-truck ratios shot up across all segments the last week of the month, pushing rates higher in the last week of the month. Flatbed capacity was particularly constrained in February, pushing rates up 4 cents from January, DAT says.