According to ATFI:

Policy #1 (limiting the use of toll revenues to toll facilities) assumes a continued reliance on overly optimistic revenue and traffic projections used to issue bonds in order to finance tolls roads. These estimates often fail to materialize once a toll road is reconstructed or maintenance is completed. Examples of revenue projections and traffic estimates far exceeding actual outcomes include SH130 in Texas, 495 HOT Lanes in Virginia, and the Intercounty Connector in Maryland.

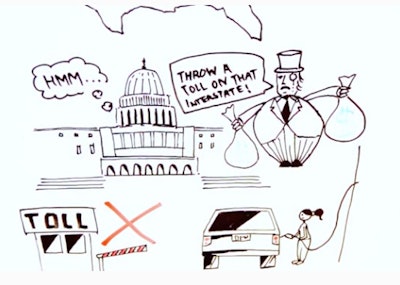

ATFI graphic

ATFI graphicPolicies #3 (toll only when construction or reconstruction of a corridor is completed) and #5 (provide a higher level of service for rebuilt tolled Interstates) assume the use of tolls as the sole funding source for all interstate construction and maintenance, while simultaneously relying on a universal Vehicle Miles Tax (VMT) to fund construction and maintenance for all other roads. Not a single state has successfully placed tolls on existing interstate capacity to date and VMT pilot programs are in their infancy at best. These assumptions are completely unrealistic for the foreseeable future.

Policy #3 also relies on an increased dependence on the costly bureaucracies created by electronic tolling. The administrative, operational, and enforcement resources expended to maintain electronic tolling systems are significant. Value-Added Tolling increases this by including a gas tax rebate system that requires users to pay twice up-front, at the pump and through a toll, and then file the appropriate paperwork to receive a rebate.