The hit song She Drives Me Crazy by the Fine Young Cannibals got me thinking about the complexity of building and marketing trucks in the Messy Middle. Whether an OEM is an established company or a hopeful start-up, the truck market is only so big.

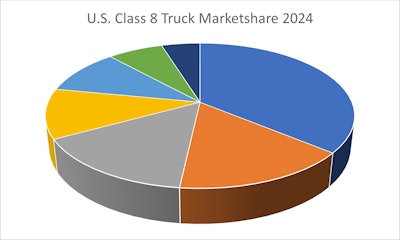

Think of the classic pie chart. Each OEM has its piece of the pie.

Each OEM is always competing to capture a larger piece of the pie. In other words, sell more trucks.

An OEM selling more trucks means another OEM will have to sell fewer trucks. That’s the reality of the competitive truck market.

OEMs are now introducing a range of competing powertrains including natural gas, battery electric, hydrogen fuel cell, hydrogen ICE, blended fuels, and more — what NACFE coined the Messy Middle.

Those new technology choices may win a customer from a competitor.

Winning a new customer will be a necessity for start-ups that do not yet have market share.

For the established OEMs, it is more complicated. While their new offerings may win over a competitor’s customer, they just as easily may cannibalize their own existing sales. For example, an OEM may sell a natural gas truck to an existing customer that previously would have bought one of its diesel trucks.

Cannibalism is a real possibility in the Messy Middle. So why would an OEM introduce more choice to the market?

There is another way to look at the Messy Middle: creating more choice may better preserve net market share for an OEM. Manufacturers may feel they will lose sales to competitors if they don’t offer more choices.

This is a defensive strategy. This is a “keeping up with the Joneses” view of the truck market. If your competitor suddenly offers a 15-liter natural gas engine truck, then you’re going to have to offer one or you may lose a sale, lose a customer and lose market share.

If a competing start-up suddenly offers battery electric trucks that people want, you better be able to offer a competitive product or you will lose sales.

When do OEMs start giving credibility to the risk of losing sales to a new technology? When their management feels the risk of ignoring it is too great. Sometimes that is way too late. Look at how the Detroit Big Three automakers misjudged the market in the 1970s and lost market share to imports from Asia and Europe.

Sometimes OEM management pulls the trigger too early, misjudges the market demand and the technologies maturity. Consider the heavy-duty truck natural gas market growth between 2010 and 2016, which didn’t take off as expected. The available product in that period didn’t meet expectations and sales did not grow as planned.

Fast forward to 2025, a new 15L natural gas engine is capturing attention. It’s too early to tell, but all indications are it’s off to a good start. I suggest, though, that those fleets that are going to buy a 15L natural gas engine likely are replacing a diesel in their fleet — an act of cannibalism to the OEM.

Don’t you envy start-ups? They have no sales to cannibalize. Every new sale is immediately new market share. Start-ups have none of the worries that existing OEMs have when it comes to cannibalizing sales.

Start-ups do have a serious concern over achieving adequate positive cash flow. They have to win enough customers fast enough to avoid bankruptcy. Even a great new product can fail if the sales don’t take off fast enough.

Timing is everything, right? Launching a new product in an economic trough could devastate an otherwise viable company. Conversely, launching a product into a marketplace with high demand and the factory not being able to fill the orders fast enough can similarly destroy a company. Some customers may be willing to wait for a new product, but for how long?

And all the time they are waiting for that new product, they still have to keep buying trucks. Trucks are capital investments, tools to make money. They wear out with use just like factory machines. They need to be replaced regularly as they become increasingly expensive to maintain with use.

2026 is going to be an interesting year for truck sales. I suggest that the crystal ball is hazy on whether or not there will be a pre-buy ahead of 2027 emissions regulations. It’s very cloudy on whether the freight market will see a significant rebound to support greater sales. It’s blurry concerning the impact of deregulation on growth of zero- and low-emission vehicle sales.

If the start-ups are successful, they will begin taking market share from the incumbent OEMs. If all the existing OEMs are offering viable competitive technologies to those from the start-ups, what is the best those existing OEMs can hope for? To maintain market share? To not lose sales?

I want to be in the board room when the OEM’s CEO announces that, “Our 2026 strategy is to not lose market share.” I’m sure that is both obvious to the board and possibly career ending for the CEO.

Maintaining the status quo means cannibalism.