Tonnage drops sharply in August

ATA’s adjusted index up 6.2 percent year-to-date

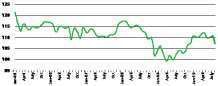

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index in August plunged 2.7 percent from the July level. The drop was the largest month-to-month decrease since March 2009. The SA index dropped from 110 in July to 106.9 in August. Compared with August 2009, SA tonnage climbed 2.9 percent, which was well below July’s 7.4 percent year-over-year gain. Year-to-date, tonnage was up 6.2 percent compared with the same period in 2009. On an absolute basis — without adjusting for seasonality — the index was up 3.2 percent from July to August.

ATA’s Truck Tonnage Index (Seasonally Adjusted; 2000=100)

ATA’s Truck Tonnage Index (Seasonally Adjusted; 2000=100)August’s data highlights that the economy, while still growing, is slowing, says ATA Chief Economist Bob Costello. “We fully anticipate sluggish economic growth for the remainder of this year, and the latest tonnage numbers are reflecting that slowdown.” Even so, Costello sees that the trucking market has changed dramatically for the better. “While I’d much rather see better tonnage figures, motor carriers can now do better with small increases in demand since so much supply left the industry during the recession.”

The base year for ATA’s index is 2000. ATA calculates the tonnage index based on surveys from its membership; the reported figure is preliminary and is subject to change in the final report issued around the 10th day of the month.

IN BRIEF

* Economic activity in the manufacturing sector expanded in September for the 14th consecutive month, although the growth is slowing, according to the latest ISM Report on Business. ISM’s PMI – a composite index of manufacturing activity – stood at 54.4 percent in September, dropping from August’s reading of 56.3 percent. An index level above 50 percent indicates that the manufacturing sector is growing.

* The ratio of inventories to sales throughout the U.S. economy edged slightly higher on a seasonally adjusted basis to 1.27 in August after two months at 1.26. Sales were up 0.1 percent over July on a seasonally adjusted basis, while inventories rose 0.6 percent. Increases in the inventories-to-sales ratio generally suggest weakening demand for transportation as manufacturers, retailers and wholesalers see less need to replenish stocks in the near term.

*Permits authorized for construction of housing units stood at a seasonally adjusted rate of 539,000 in September – 5.6 percent below the revised August rate and 10.9 percent below the September 2009 estimate, the U.S. Census Bureau reported. Housing starts were at a seasonally adjusted annual rate of 610,000, which is 0.3 percent above the revised August estimate and 4.1 percent above September 2009.

* Exports of U.S. goods in August totaled $107.7 billion, virtually unchanged from the July level, the U.S. Census Bureau said. Imports of goods increased $3.9 billion to $166.7 billion. Changes in exports have a greater effect on trucking than imports because they represent both shipments of raw materials, parts and components as well as outbound shipments of finished goods.

Trucking jobs flat after upward revisions

Estimated payroll employment in trucking was practically unchanged on a seasonally adjusted basis in September, dipping by 100 jobs throughout the industry, according to preliminary figures released by the U.S. Department of Labor’s Bureau of Labor Statistics. But BLS also revised upward its July and August figures by 1,300 and 2,600, respectively. Since the beginning of March, trucking companies have added 15,200 jobs, according to the latest estimates.

Total nonfarm payroll employment declined by 95,000 in September. Government jobs were down by 159,000, while private-sector employment grew by 64,000. n